Okama

okama is a library with investment portfolio analyzing & optimization tools. CFA recommendations are used in quantitative finance.

okama goes with free «end of day» historical stock markets data and macroeconomic indicators through API.

...entities should not be multiplied without necessity

-- William of Ockham (c. 1287–1347)

Table of contents

Okama main features

- Investment portfolio constrained Markowitz Mean-Variance Analysis (MVA) and optimization

- Rebalanced portfolio optimization with constraints (multi-period Efficient Frontier)

- Investment portfolios with contributions / withdrawals cash flows (DCF)

- Monte Carlo Simulations for financial assets and investment portfolios

- Popular risk metrics: VAR, CVaR, semi-deviation, variance and drawdowns

- Different financial ratios: CAPE10, Sharpe ratio, Sortino ratio, Diversification ratio

- Forecasting models according to normal, lognormal and other popular distributions

- Testing distribution on historical data

- Dividend yield and other dividend indicators for stocks

- Backtesting and comparing historical performance of broad range of assets and indexes in multiple currencies

- Methods to track the performance of index funds (ETF) and compare them with benchmarks

- Main macroeconomic indicators: inflation, central banks rates

- Matplotlib visualization scripts for the Efficient Frontier, Transition map and assets risk / return performance

Financial data and macroeconomic indicators

End of day historical data

- Stocks and ETF for main world markets

- Mutual funds

- Commodities

- Stock indexes

Currencies

- FX currencies

- Crypto currencies

- Central bank exchange rates

Macroeconomic indicators

For many countries (China, USA, United Kingdom, European Union, Russia, Israel etc.):

- Inflation

- Central bank rates

- CAPE10 (Shiller P/E) Cyclically adjusted price-to-earnings ratios

Other historical data

- Real estate prices

- Top bank rates

Installation

pip install okama

The latest development version can be installed directly from GitHub:

git clone https://github.com/mbk-dev/okama@dev

poetry install

Getting started

1. Compare several assets from different stock markets. Get USD-adjusted performance

import okama as ok

x = ok.AssetList(['SPY.US', 'BND.US', 'DBXD.XFRA'], ccy='USD')

x

Get the main parameters for the set:

x.describe()

Get the assets accumulated return, plot it and compare with the USD inflation:

x.wealth_indexes.plot()

2. Create a dividend stocks portfolio with base currency EUR

weights = [0.3, 0.2, 0.2, 0.2, 0.1]

assets = ['T.US', 'XOM.US', 'FRE.XFRA', 'SNW.XFRA', 'LKOH.MOEX']

pf = ok.Portfolio(assets, weights=weights, ccy='EUR')

pf.table

Plot the dividend yield of the portfolio (adjusted to the base currency).

pf.dividend_yield.plot()

3. Draw an Efficient Frontier for 2 popular ETF: SPY and GLD

ls = ['SPY.US', 'GLD.US']

curr = 'USD'

last_date='2020-10'

frontier = ok.EfficientFrontierReb(ls, last_date=last_date, ccy=curr, rebalancing_period='year')

frontier.names

Get the Efficient Frontier points for rebalanced portfolios and plot the chart with the assets risk/CAGR points:

import matplotlib.pyplot as plt

points = frontier.ef_points

fig = plt.figure(figsize=(12,6))

fig.subplots_adjust(bottom=0.2, top=1.5)

frontier.plot_assets(kind='cagr')

ax = plt.gca()

ax.plot(points.Risk, points.CAGR)

* - rebalancing period is one year.

4. Get a Transition Map for allocations

ls = ['SPY.US', 'GLD.US', 'BND.US']

map = ok.EfficientFrontier(ls, ccy='USD').plot_transition_map(x_axe='risk')

More examples are available in form of Jupyter Notebooks.

Documentation

The official documentation is hosted on readthedocs.org: https://okama.readthedocs.io/

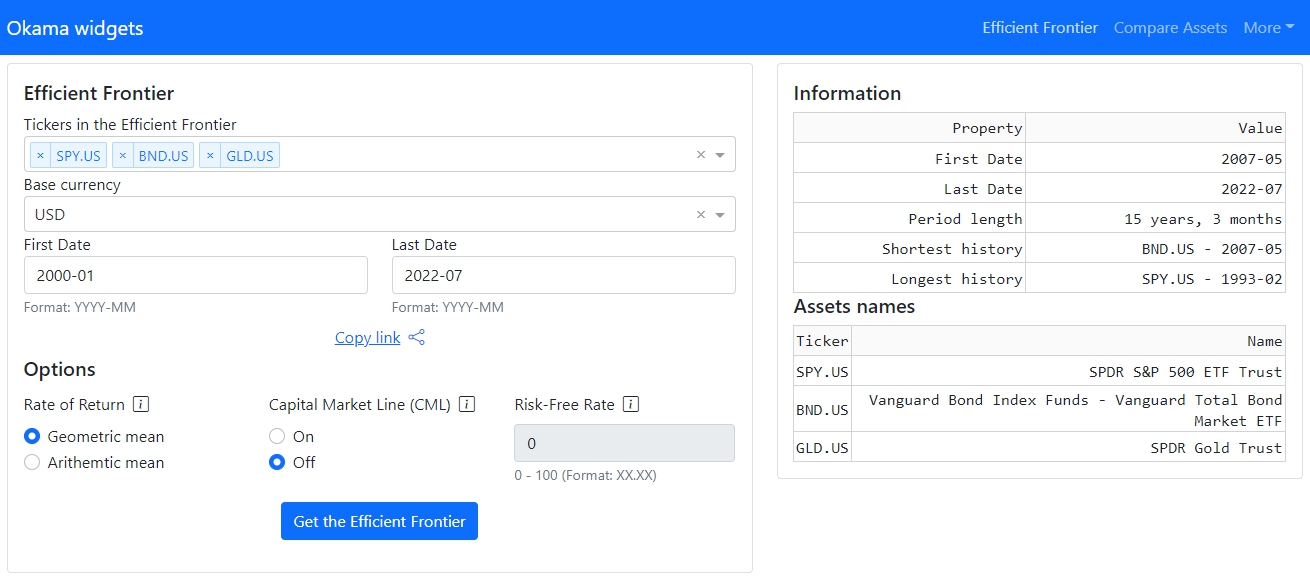

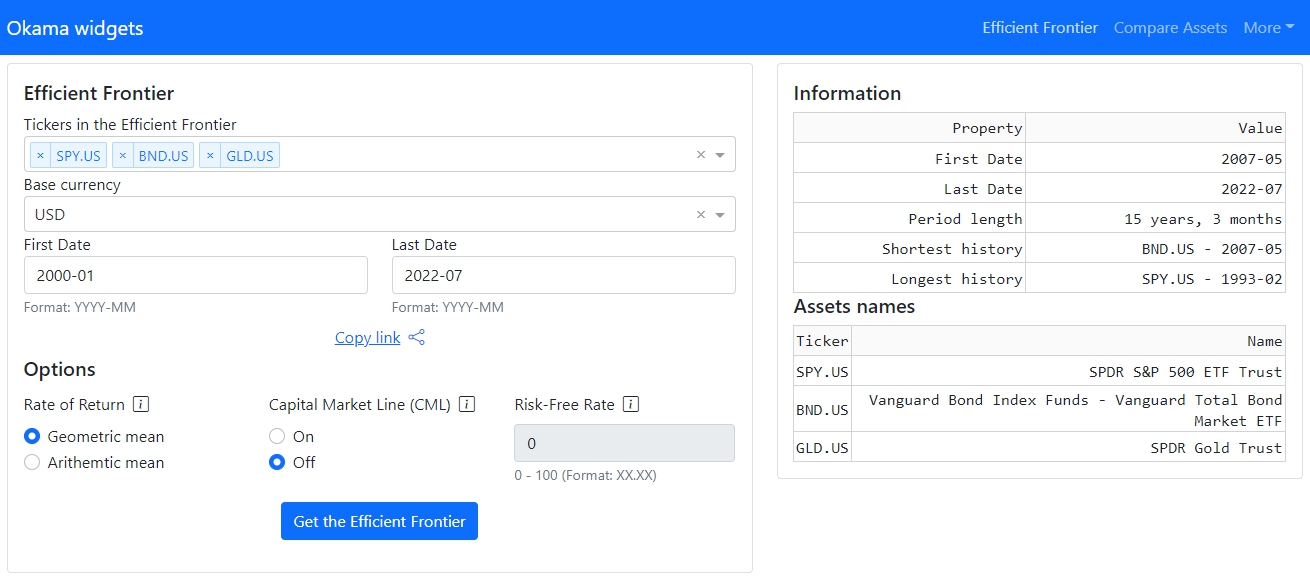

Financial Widgets

okama-dash repository has interactive financial widgets (multi-page web application)

build with okama package and Dash (plotly) framework. Working example is available at

okama.io.

RoadMap

The plan for okama is to add more functions that will be useful to investors and asset managers.

- Add Omega ratio to EfficientFrontier, EfficientFrontierReb and Portfolio classes.

- Make complex withdrawals / contributions strategies in Portfolio class.

- Make complex portfolio rebalancing strategies.

- Add Black-Litterman asset allocation

- Accelerate optimization for multi-period Efficient Frontier: minimize_risk and maximize_risk methods of EfficientFrontierReb class.

- Make a single EfficientFrontier class for all optimizations: single-period or multu-period with rebalancing period as a parameter.

- Add different utility functions for optimizers: IRR, portfolio survival period, semi-deviation, VaR, CVaR, drawdowns etc.

- Add more functions based on suggestion of users.

Contributing to okama

Contributions are most welcome. Have a look at the Contribution Guide for more.

Feel free to ask questions on Discussuions.

As contributors and maintainers to this project, you are expected to abide by okama' code of conduct. More information can be found at: Contributor Code of Conduct

Communication

For basic usage questions (e.g., "Is XXX currency supported by okama?") and for sharing ideas please use GitHub Discussions.

Russian language community is available at okama.io forums.

License

MIT