Product

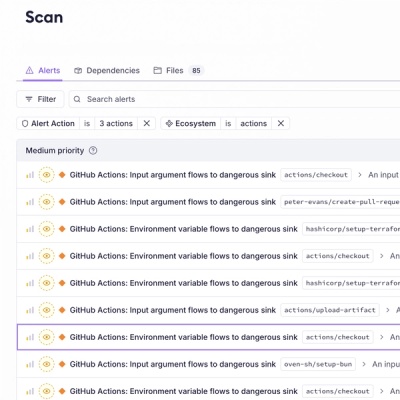

Introducing GitHub Actions Scanning Support

Detect malware, unsafe data flows, and license issues in GitHub Actions with Socket’s new workflow scanning support.

card-validator

Advanced tools

Credit Card Validator provides validation utilities for credit card data inputs. It is designed as a CommonJS module for use in Node.js, io.js, or the browser. It includes first class support for 'potential' validity so you can use it to present appropriate UI to your user as they type.

A typical use case in a credit card form is to notify the user if the data they are entering is invalid. In a credit card field, entering “411” is not necessarily valid for submission, but it is still potentially valid. Conversely, if a user enters “41x” that value can no longer pass strict validation and you can provide a response immediately.

Credit Card Validator will also provide a determined card type (using credit-card-type). This is useful for scenarios in which you wish to render an accompanying payment method icon (Visa, MasterCard, etc.). Additionally, by having access to the current card type, you can better manage the state of your credit card form as a whole. For example, if you detect a user is entering (or has entered) an American Express card number, you can update the maxlength attribute of your CVV input element from 3 to 4 and even update the corresponding label from 'CVV' to 'CID'.

You can install card-validator through npm.

npm install card-validator

var valid = require("card-validator");

var numberValidation = valid.number("4111");

if (!numberValidation.isPotentiallyValid) {

renderInvalidCardNumber();

}

if (numberValidation.card) {

console.log(numberValidation.card.type); // 'visa'

}

var valid = require('card-validator');valid.number(value: string, [options: object]): object{

card: {

niceType: 'American Express',

type: 'american-express',

gaps: [4, 10],

lengths: [15],

code: {name: 'CID', size: 4}

},

isPotentiallyValid: true, // if false, indicates there is no way the card could be valid

isValid: true // if true, number is valid for submission

}

You can optionally pass luhnValidateUnionPay as a property of an object as a second argument. This will override the default behavior to ignore luhn validity of UnionPay cards.

valid.number(<Luhn Invalid UnionPay Card Number>, {luhnValidateUnionPay: true});

{

card: {

niceType: 'UnionPay',

type: 'unionpay',

gaps: [4, 8, 12],

lengths: [16, 17, 18, 19],

code: {name: 'CVN', size: 3}

},

isPotentiallyValid: true,

isValid: false // Would be true if no options were included

}

You can optionally pass maxLength as a property of an object as a second argument. This will override the default behavior to use the card type's max length property and mark any cards that exceed the max length as invalid.

If a card brand has a normal max length that is shorter than the passed in max length, the validator will use the shorter one. For instance, if a maxLength of 16 is provided, the validator will still use 15 as the max length for American Express cards.

You can optionally pass skipLuhnValidation: true as a property of an object as a second argument. This will override the default behaviour and will skip the validation of the check digit of the card number using Luhn Algorithm. The skipLuhnValidation should not be set to true in production environment.

valid.number(<Maestro Card with 19 Digits>, {maxLength: 16});

{

card: {

// Maestro card data

},

isPotentiallyValid: false,

isValid: false

}

If a valid card type cannot be determined, the card field in the response will be null.

A fake session where a user is entering a card number may look like:

| Input | Output | Suggested Handling | |||

|---|---|---|---|---|---|

| Value | card.type | isPotentiallyValid | isValid | Render Invalid UI | Allow Submit |

'' | null | true | false | no | no |

'6' | null | true | false | no | no |

'60' | 'discover' | true | false | no | no |

'601' | 'discover' | true | false | no | no |

'6011' | 'discover' | true | false | no | no |

'601' | 'discover' | true | false | no | no |

'60' | 'discover' | true | false | no | no |

'6' | null | true | false | no | no |

'' | null | true | false | no | no |

'x' | null | false | false | yes | no |

'' | null | true | false | no | no |

'4' | 'visa' | true | false | no | no |

'41' | 'visa' | true | false | no | no |

'411' | 'visa' | true | false | no | no |

'4111111111111111' | 'visa' | true | true | no | yes |

'411x' | null | false | false | yes | no |

valid.cardholderName(value: string): objectThe cardholderName validation essentially tests for a valid string greater than 0 characters in length that does not look like a card number.

{

isPotentiallyValid: true,

isValid: true

}

If a cardholder name is comprised of only numbers, hyphens and spaces, the validator considers it to be too card-like to be valid, but may still be potentially valid if a non-numeric character is added. This is to prevent card number values from being sent along as the cardholder name but not make too many assumptions about a person's cardholder name.

{

isPotentiallyValid: true,

isValid: false

}

If a cardholder name is longer than 255 characters, it is assumed to be invalid.

{

isPotentiallyValid: false,

isValid: false

}

valid.expirationDate(value: string|object, maxElapsedYear: integer): objectThe maxElapsedYear parameter determines how many years in the future a card's expiration date should be considered valid. It has a default value of 19, so cards with an expiration date 20 or more years in the future would not be considered valid. It can be overridden by passing in an integer as a second argument.

{

isPotentiallyValid: true, // if false, indicates there is no way this could be valid in the future

isValid: true,

month: '10', // a string with the parsed month if valid, null if either month or year are invalid

year: '2016' // a string with the parsed year if valid, null if either month or year are invalid

}

expirationDate will parse strings in a variety of formats:

| Input | Output |

|---|---|

'10/19''10 / 19''1019''10 19' | {month: '10', year: '19'} |

'10/2019''10 / 2019''102019''10 2019''10 19' | {month: '10', year: '2019'} |

'2019-10' | {month: '10', year: '2019'} |

{month: '01', year: '19'}{month: '1', year: '19'}{month: 1, year: 19} | {month: '01', year: '19'} |

{month: '01', year: '2019'}{month: '1', year: '2019'}{month: 1, year: 2019} | {month: '01', year: '2019'} |

valid.expirationMonth(value: string): objectexpirationMonth accepts 1 or 2 digit months. 1, 01, 10 are all valid entries.

{

isValidForThisYear: false,

isPotentiallyValid: true,

isValid: true

}

valid.expirationYear(value: string, maxElapsedYear: integer): objectexpirationYear accepts 2 or 4 digit years. 16 and 2016 are both valid entries.

The maxElapsedYear parameter determines how many years in the future a card's expiration date should be considered valid. It has a default value of 19, so cards with an expiration date 20 or more years in the future would not be considered valid. It can be overridden by passing in an integer as a second argument.

{

isCurrentYear: false,

isPotentiallyValid: true,

isValid: true

}

valid.cvv(value: string, maxLength: integer): objectThe cvv validation by default tests for a numeric string of 3 characters in length. The maxLength can be overridden by passing in an integer as a second argument. You would typically switch this length from 3 to 4 in the case of an American Express card which expects a 4 digit CID.

{

isPotentiallyValid: true,

isValid: true

}

valid.postalCode(value: string, [options: object]): objectThe postalCode validation essentially ignores leading/trailing whitespace and tests for a valid string greater than 3 characters in length. It also verifies that the first 3 letters are alphanumeric.

{

isPotentiallyValid: true,

isValid: true

}

You can optionally pass minLength as a property of an object as a second argument. This will override the default min length of 3 and verify that the characters for the specified length are all alphanumeric.

valid.postalCode('123', {minLength: 5});

{

isPotentiallyValid: true,

isValid: false

}

Card Validator exposes the credit-card-type module as creditCardType. You can add custom card brands by utilizing the addCard method.

valid.creditCardType.addCard({

niceType: "NewCard",

type: "new-card",

patterns: [1234],

gaps: [4, 8, 12],

lengths: [16],

code: {

name: "CVV",

size: 3,

},

});

valid.expirationDate will only return month: and year: as strings if the two are valid, otherwise they will be null.postalCode will allow non-number characters to be used in validation.We use nvm for managing our node versions, but you do not have to. Replace any nvm references with the tool of your choice below.

nvm install

npm install

All testing dependencies will be installed upon npm install. Run the test suite with npm test.

creditcard.js is a library for validating credit card numbers, expiration dates, and CVV codes. It offers similar functionalities to card-validator but with a different API design. It is also lightweight and easy to integrate into web applications.

The card package provides utilities for validating and formatting credit card information. It includes features for validating card numbers, expiration dates, and CVV codes, similar to card-validator. Additionally, it offers formatting utilities to display card information in a user-friendly manner.

The payment package is a comprehensive library for handling credit card validation and formatting. It includes features for validating card numbers, expiration dates, and CVV codes, as well as utilities for formatting and masking card information. It is a robust alternative to card-validator with additional formatting capabilities.

FAQs

A library for validating credit card fields

The npm package card-validator receives a total of 402,779 weekly downloads. As such, card-validator popularity was classified as popular.

We found that card-validator demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 1 open source maintainer collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Product

Detect malware, unsafe data flows, and license issues in GitHub Actions with Socket’s new workflow scanning support.

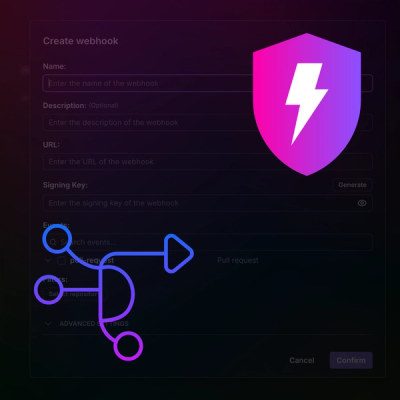

Product

Add real-time Socket webhook events to your workflows to automatically receive pull request scan results and security alerts in real time.

Research

The Socket Threat Research Team uncovered malicious NuGet packages typosquatting the popular Nethereum project to steal wallet keys.