Security News

TC39 Advances 11 Proposals for Math Precision, Binary APIs, and More

TC39 advances 11 JavaScript proposals, with two moving to Stage 4, bringing better math, binary APIs, and more features one step closer to the ECMAScript spec.

examples folder is removed and examples are renamed and kept in root directory for ease of developmentgit clone https://github.com/algo2t/alphatrade.gitpython -m pip install virtualenv and then python -m virtualenv venv and activate the venv environment.python -m pip install -r dev-requirements.txt - this is to ensure setuptools==57.5.0 is installed. There is a bug with protlib, target is to get reed of protlib in futurepython -m pip install -r requirement.txtconfig.py file in root of cloned repo with login_id, password and TOTP SECRET, you can add the access_token.txt if you want to use existing access_token.python zlogin_example.py, python zexample_sas_login.py, python zhistorical_data.py and python zstreaming_data.pyThe Python APIs for communicating with the SAS Online Alpha Trade Web Platform.

Alpha Trade Python library provides an easy to use python wrapper over the HTTPS APIs.

The HTTP calls have been converted to methods and JSON responses are wrapped into Python-compatible objects.

Websocket connections are handled automatically within the library.

This work is completely based on Python SDK / APIs for AliceBlueOnline.

Thanks to krishnavelu.

This module is installed via pip:

pip install git+https://github.com/algo2t/alphatrade.git

It can also be installed from pypi

pip install alphatrade

To force upgrade existing installations:

pip uninstall alphatrade

pip --no-cache-dir install --upgrade alphatrade

Python 3.x

Also, you need the following modules:

protlibwebsocket_clientrequestspandasThe modules can also be installed using pip

Please clone this repository and check the examples folder to get started.

Check here

There is only one class in the whole library: AlphaTrade. When the AlphaTrade object is created an access token from the SAS Online alpha trade server is stored in text file access_token.txt in the same directory. An access token is valid for 24 hours. See the examples folder with config.py file to see how to store your credentials.

With an access token, you can instantiate an AlphaTrade object again. Ideally you only need to create an access_token once every day.

The original REST API that this SDK is based on is available online. Alice Blue API REST documentation

The whole library is equipped with python‘s logging module for debugging. If more debug information is needed, enable logging using the following code.

import logging

logging.basicConfig(level=logging.DEBUG)

from alphatrade import *

config.py filelogin_id = "XXXXX"

password = "XXXXXXXX"

Totp = 'XXXXXXXXXXXXXXXX'

try:

access_token = open('access_token.txt', 'r').read().rstrip()

except Exception as e:

print('Exception occurred :: {}'.format(e))

access_token = None

import config

AlphaTrade object with your login_id, password, TOTP / TOTP_SECRET and/or access_token.Use config object to get login_id, password, TOTP and access_token.

from alphatrade import AlphaTrade

import config

import pyotp

Totp = config.Totp

pin = pyotp.TOTP(Totp).now()

totp = f"{int(pin):06d}" if len(pin) <=5 else pin

sas = AlphaTrade(login_id=config.login_id, password=config.password, twofa=totp, access_token=config.access_token)

## filename config.py

login_id = "RR24XX"

password = "SuperSecretPassword!!!"

TOTP_SECRET = 'YOURTOTPSECRETEXTERNALAUTH'

try:

access_token = open('access_token.txt', 'r').read().rstrip()

except Exception as e:

print(f'Exception occurred :: {e}')

access_token = None

from alphatrade import AlphaTrade

import config

import pyotp

sas = AlphaTrade(login_id=config.login_id, password=config.password, twofa=config.TOTP_SECRET, access_token=config.access_token)

print(sas.get_balance()) # get balance / margin limits

print(sas.get_profile()) # get profile

print(sas.get_daywise_positions()) # get daywise positions

print(sas.get_netwise_positions()) # get netwise positions

print(sas.get_holding_positions()) # get holding positions

Getting master contracts allow you to search for instruments by symbol name and place orders.

Master contracts are stored as an OrderedDict by token number and by symbol name. Whenever you get a trade update, order update, or quote update, the library will check if master contracts are loaded. If they are, it will attach the instrument object directly to the update. By default all master contracts of all enabled exchanges in your personal profile will be downloaded. i.e. If your profile contains the following as enabled exchanges ['NSE', 'BSE', 'CDS', 'MCX', NFO'] all contract notes of all exchanges will be downloaded by default. If you feel it takes too much time to download all exchange, or if you don‘t need all exchanges to be downloaded, you can specify which exchange to download contract notes while creating the AlphaTrade object.

sas = AlphaTrade(login_id=config.login_id, password=config.password, twofa=totp, access_token=config.access_token, master_contracts_to_download=['NSE', 'BSE'])

This will reduce a few milliseconds in object creation time of AlphaTrade object.

Symbols can be retrieved in multiple ways. Once you have the master contract loaded for an exchange, you can get an instrument in many ways.

Get a single instrument by it‘s name:

tatasteel_nse_eq = sas.get_instrument_by_symbol('NSE', 'TATASTEEL')

reliance_nse_eq = sas.get_instrument_by_symbol('NSE', 'RELIANCE')

ongc_bse_eq = sas.get_instrument_by_symbol('BSE', 'ONGC')

india_vix_nse_index = sas.get_instrument_by_symbol('NSE', 'India VIX')

sensex_nse_index = sas.get_instrument_by_symbol('BSE', 'SENSEX')

Get a single instrument by it‘s token number (generally useful only for BSE Equities):

ongc_bse_eq = sas.get_instrument_by_token('BSE', 500312)

reliance_bse_eq = sas.get_instrument_by_token('BSE', 500325)

acc_nse_eq = sas.get_instrument_by_token('NSE', 22)

Get FNO instruments easily by mentioning expiry, strike & call or put.

bn_fut = sas.get_instrument_for_fno(symbol = 'BANKNIFTY', expiry_date=datetime.date(2019, 6, 27), is_fut=True, strike=None, is_call = False)

bn_call = sas.get_instrument_for_fno(symbol = 'BANKNIFTY', expiry_date=datetime.date(2019, 6, 27), is_fut=False, strike=30000, is_call = True)

bn_put = sas.get_instrument_for_fno(symbol = 'BANKNIFTY', expiry_date=datetime.date(2019, 6, 27), is_fut=False, strike=30000, is_call = False)

Search for multiple instruments by matching the name. This works case insensitive and returns all instrument which has the name in its symbol.

all_sensex_scrips = sas.search_instruments('BSE', 'sEnSeX')

print(all_sensex_scrips)

The above code results multiple symbol which has ‘sensex’ in its symbol.

[Instrument(exchange='BSE', token=1, symbol='SENSEX', name='SENSEX', expiry=None, lot_size=None), Instrument(exchange='BSE', token=540154, symbol='IDFSENSEXE B', name='IDFC Mutual Fund', expiry=None, lot_size=None), Instrument(exchange='BSE', token=532985, symbol='KTKSENSEX B', name='KOTAK MAHINDRA MUTUAL FUND', expiry=None, lot_size=None), Instrument(exchange='BSE', token=538683, symbol='NETFSENSEX B', name='NIPPON INDIA ETF SENSEX', expiry=None, lot_size=None), Instrument(exchange='BSE', token=535276, symbol='SBISENSEX B', name='SBI MUTUAL FUND - SBI ETF SENS', expiry=None, lot_size=None)]

Search for multiple instruments by matching multiple names

multiple_underlying = ['BANKNIFTY','NIFTY','INFY','BHEL']

all_scripts = sas.search_instruments('NFO', multiple_underlying)

Instruments are represented by instrument objects. These are named-tuples that are created while getting the master contracts. They are used when placing an order and searching for an instrument. The structure of an instrument tuple is as follows:

Instrument = namedtuple('Instrument', ['exchange', 'token', 'symbol',

'name', 'expiry', 'lot_size'])

All instruments have the fields mentioned above. Wherever a field is not applicable for an instrument (for example, equity instruments don‘t have strike prices), that value will be None

Once you have master contracts loaded, you can easily subscribe to quote updates.

You can subscribe any one type of quote update for a given scrip. Using the LiveFeedType enum, you can specify what type of live feed you need.

LiveFeedType.MARKET_DATALiveFeedType.COMPACTLiveFeedType.SNAPQUOTELiveFeedType.FULL_SNAPQUOTEPlease refer to the original documentation here for more details of different types of quote update.

sas.subscribe(sas.get_instrument_by_symbol('NSE', 'TATASTEEL'), LiveFeedType.MARKET_DATA)

sas.subscribe(sas.get_instrument_by_symbol('BSE', 'RELIANCE'), LiveFeedType.COMPACT)

Subscribe to multiple instruments in a single call. Give an array of instruments to be subscribed.

sas.subscribe([sas.get_instrument_by_symbol('NSE', 'TATASTEEL'), sas.get_instrument_by_symbol('NSE', 'ACC')], LiveFeedType.MARKET_DATA)

Note: There is a limit of 250 scrips that can be subscribed on total. Beyond this point the server may disconnect web-socket connection.

Start getting live feed via socket

socket_opened = False

def event_handler_quote_update(message):

print(f"quote update {message}")

def open_callback():

global socket_opened

socket_opened = True

sas.start_websocket(subscribe_callback=event_handler_quote_update,

socket_open_callback=open_callback,

run_in_background=True)

while(socket_opened==False):

pass

sas.subscribe(sas.get_instrument_by_symbol('NSE', 'ONGC'), LiveFeedType.MARKET_DATA)

sleep(10)

Unsubscribe to an existing live feed

sas.unsubscribe(sas.get_instrument_by_symbol('NSE', 'TATASTEEL'), LiveFeedType.MARKET_DATA)

sas.unsubscribe(sas.get_instrument_by_symbol('BSE', 'RELIANCE'), LiveFeedType.COMPACT)

Unsubscribe to multiple instruments in a single call. Give an array of instruments to be unsubscribed.

sas.unsubscribe([sas.get_instrument_by_symbol('NSE', 'TATASTEEL'), sas.get_instrument_by_symbol('NSE', 'ACC')], LiveFeedType.MARKET_DATA)

sas.get_all_subscriptions() # All

Subscribe to market status messages

sas.subscribe_market_status_messages()

Getting market status messages.

print(sas.get_market_status_messages())

Example result of get_market_status_messages()

[{'exchange': 'NSE', 'length_of_market_type': 6, 'market_type': b'NORMAL', 'length_of_status': 31, 'status': b'The Closing Session has closed.'}, {'exchange': 'NFO', 'length_of_market_type': 6, 'market_type': b'NORMAL', 'length_of_status': 45, 'status': b'The Normal market has closed for 22 MAY 2020.'}, {'exchange': 'CDS', 'length_of_market_type': 6, 'market_type': b'NORMAL', 'length_of_status': 45, 'status': b'The Normal market has closed for 22 MAY 2020.'}, {'exchange': 'BSE', 'length_of_market_type': 13, 'market_type': b'OTHER SESSION', 'length_of_status': 0, 'status': b''}]

Note: As per alice blue documentation all market status messages should be having a timestamp. But in actual the server doesn‘t send timestamp, so the library is unable to get timestamp for now.

Subscribe to exchange messages

sas.subscribe_exchange_messages()

Getting market status messages.

print(sas.get_exchange_messages())

Example result of get_exchange_messages()

[{'exchange': 'NSE', 'length': 32, 'message': b'DS : Bulk upload can be started.', 'exchange_time_stamp': 1590148595}, {'exchange': 'NFO', 'length': 200, 'message': b'MARKET WIDE LIMIT FOR VEDL IS 183919959. OPEN POSITIONS IN VEDL HAVE REACHED 84 PERCENT OF THE MARKET WIDE LIMIT. ', 'exchange_time_stamp': 1590146132}, {'exchange': 'CDS', 'length': 54, 'message': b'DS : Regular segment Bhav copy broadcast successfully.', 'exchange_time_stamp': 1590148932}, {'exchange': 'MCX', 'length': 7, 'message': b'.......', 'exchange_time_stamp': 1590196159}]

socket_opened = False

def market_status_messages(message):

print(f"market status messages {message}")

def exchange_messages(message):

print(f"exchange messages {message}")

def open_callback():

global socket_opened

socket_opened = True

sas.start_websocket(market_status_messages_callback=market_status_messages,

exchange_messages_callback=exchange_messages,

socket_open_callback=open_callback,

run_in_background=True)

while(socket_opened==False):

pass

sas.subscribe_market_status_messages()

sas.subscribe_exchange_messages()

sleep(10)

Place limit, market, SL, SL-M, AMO, BO, CO orders

print (sas.get_profile())

# TransactionType.Buy, OrderType.Market, ProductType.Delivery

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%1%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.Market,

product_type = ProductType.Delivery,

price = 0.0,

trigger_price = None,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.Market, ProductType.Intraday

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%2%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.Market,

product_type = ProductType.Intraday,

price = 0.0,

trigger_price = None,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.Market, ProductType.CoverOrder

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%3%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.Market,

product_type = ProductType.CoverOrder,

price = 0.0,

trigger_price = 7.5, # trigger_price Here the trigger_price is taken as stop loss (provide stop loss in actual amount)

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.Limit, ProductType.BracketOrder

# OCO Order can't be of type market

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%4%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.Limit,

product_type = ProductType.BracketOrder,

price = 8.0,

trigger_price = None,

stop_loss = 6.0,

square_off = 10.0,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.Limit, ProductType.Intraday

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%5%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.Limit,

product_type = ProductType.Intraday,

price = 8.0,

trigger_price = None,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.Limit, ProductType.CoverOrder

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%6%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.Limit,

product_type = ProductType.CoverOrder,

price = 7.0,

trigger_price = 6.5, # trigger_price Here the trigger_price is taken as stop loss (provide stop loss in actual amount)

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

###############################

# TransactionType.Buy, OrderType.StopLossMarket, ProductType.Delivery

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%7%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.StopLossMarket,

product_type = ProductType.Delivery,

price = 0.0,

trigger_price = 8.0,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.StopLossMarket, ProductType.Intraday

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%8%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.StopLossMarket,

product_type = ProductType.Intraday,

price = 0.0,

trigger_price = 8.0,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.StopLossMarket, ProductType.CoverOrder

# CO order is of type Limit and And Market Only

# TransactionType.Buy, OrderType.StopLossMarket, ProductType.BO

# BO order is of type Limit and And Market Only

###################################

# TransactionType.Buy, OrderType.StopLossLimit, ProductType.Delivery

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%9%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.StopLossMarket,

product_type = ProductType.Delivery,

price = 8.0,

trigger_price = 8.0,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.StopLossLimit, ProductType.Intraday

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%10%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.StopLossLimit,

product_type = ProductType.Intraday,

price = 8.0,

trigger_price = 8.0,

stop_loss = None,

square_off = None,

trailing_sl = None,

is_amo = False)

)

# TransactionType.Buy, OrderType.StopLossLimit, ProductType.CoverOrder

# CO order is of type Limit and And Market Only

# TransactionType.Buy, OrderType.StopLossLimit, ProductType.BracketOrder

print ("%%%%%%%%%%%%%%%%%%%%%%%%%%%%11%%%%%%%%%%%%%%%%%%%%%%%%%%%%%")

print(

sas.place_order(transaction_type = TransactionType.Buy,

instrument = sas.get_instrument_by_symbol('NSE', 'INFY'),

quantity = 1,

order_type = OrderType.StopLossLimit,

product_type = ProductType.BracketOrder,

price = 8.0,

trigger_price = 8.0,

stop_loss = 1.0,

square_off = 1.0,

trailing_sl = 20,

is_amo = False)

)

Basket order is used to buy or sell group of securities simultaneously.

order1 = { "instrument" : sas.get_instrument_by_symbol('NSE', 'INFY'),

"order_type" : OrderType.Market,

"quantity" : 1,

"transaction_type" : TransactionType.Buy,

"product_type" : ProductType.Delivery}

order2 = { "instrument" : sas.get_instrument_by_symbol('NSE', 'SBIN'),

"order_type" : OrderType.Limit,

"quantity" : 2,

"price" : 280.0,

"transaction_type" : TransactionType.Sell,

"product_type" : ProductType.Intraday}

order = [order1, order2]

print(sas.place_basket_order(orders))

sas.cancel_order('170713000075481') #Cancel an open order

print(sas.get_order_history('170713000075481'))

print(sas.get_order_history())

print(sas.get_trade_book())

This will provide historical data but not for current day.

This returns a pandas DataFrame object which be used with pandas_ta to get various indicators values.

from datetime import datetime

print(sas.get_historical_candles('MCX', 'NATURALGAS NOV FUT', datetime(2020, 10, 19), datetime.now() ,interval=30))

Output

Instrument(exchange='MCX', token=224365, symbol='NATURALGAS NOV FUT', name='', expiry=datetime.date(2020, 11, 24), lot_size=None)

open high low close volume

date

2020-10-19 09:00:00+05:30 238.9 239.2 238.4 239.0 373

2020-10-19 09:30:00+05:30 239.0 239.0 238.4 238.6 210

2020-10-19 10:00:00+05:30 238.7 238.7 238.1 238.1 213

2020-10-19 10:30:00+05:30 238.0 238.4 238.0 238.1 116

2020-10-19 11:00:00+05:30 238.1 238.2 238.0 238.0 69

... ... ... ... ... ...

2020-10-23 21:00:00+05:30 237.5 238.1 237.3 237.6 331

2020-10-23 21:30:00+05:30 237.6 238.5 237.6 237.9 754

2020-10-23 22:00:00+05:30 237.9 238.1 237.2 237.9 518

2020-10-23 22:30:00+05:30 237.9 238.7 237.7 238.1 897

2020-10-23 23:00:00+05:30 238.2 238.3 236.3 236.5 1906

Better way to get historical data, first get the latest version from github

python -m pip install git+https://github.com/algo2t/alphatrade.git

from datetime import datetime

india_vix_nse_index = sas.get_instrument_by_symbol('NSE', 'India VIX')

print(sas.get_historical_candles(india_vix_nse_index.exchange, india_vix_nse_index.symbol, datetime(2020, 10, 19), datetime.now() ,interval=30))

This will give candles data for current day only.

This returns a pandas DataFrame object which be used with pandas_ta to get various indicators values.

print(sas.get_intraday_candles('MCX', 'NATURALGAS NOV FUT', interval=15))

Better way to get intraday data, first get the latest version from github

python -m pip install git+https://github.com/algo2t/alphatrade.git

from datetime import datetime

nifty_bank_nse_index = sas.get_instrument_by_symbol('NSE', 'Nifty Bank')

print(sas.get_intraday_candles(nifty_bank_nse_index.exchange, nifty_bank_nse_index.symbol, datetime(2020, 10, 19), datetime.now(), interval=10))

Order properties such as TransactionType, OrderType, and others have been safely classified as enums so you don‘t have to write them out as strings

Transaction types indicate whether you want to buy or sell. Valid transaction types are of the following:

TransactionType.Buy - buyTransactionType.Sell - sellOrder type specifies the type of order you want to send. Valid order types include:

OrderType.Market - Place the order with a market priceOrderType.Limit - Place the order with a limit price (limit price parameter is mandatory)OrderType.StopLossLimit - Place as a stop loss limit orderOrderType.StopLossMarket - Place as a stop loss market orderProduct types indicate the complexity of the order you want to place. Valid product types are:

ProductType.Intraday - Intraday order that will get squared off before market closeProductType.Delivery - Delivery order that will be held with you after market closeProductType.CoverOrder - Cover orderProductType.BracketOrder - One cancels other order. Also known as bracket orderHere, examples directory there are 3 files zlogin_example.py, zstreaming_data.py and stop.txt

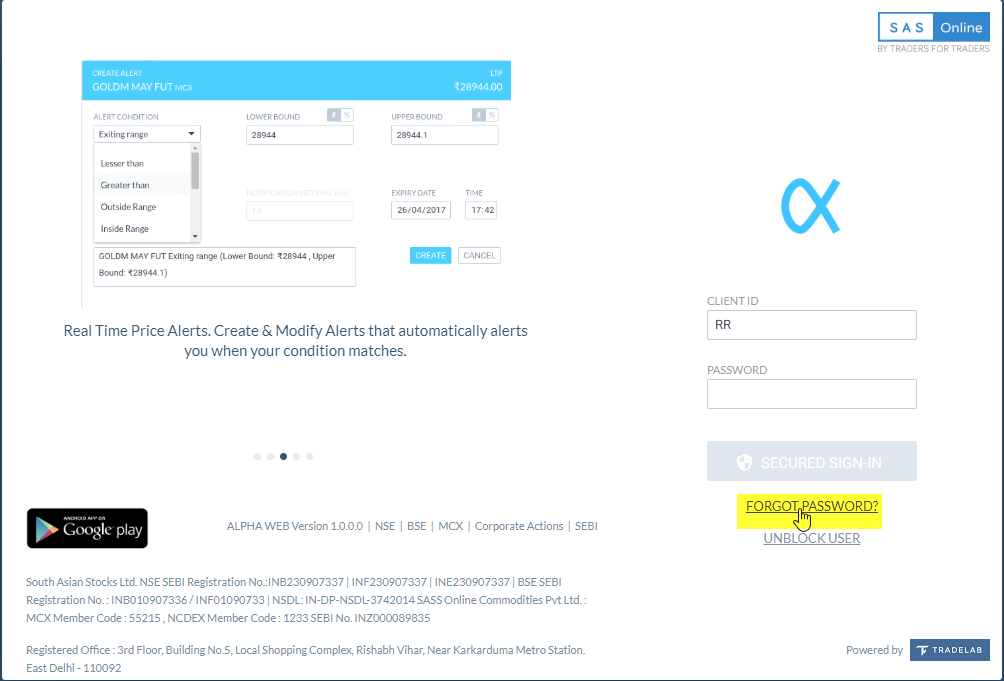

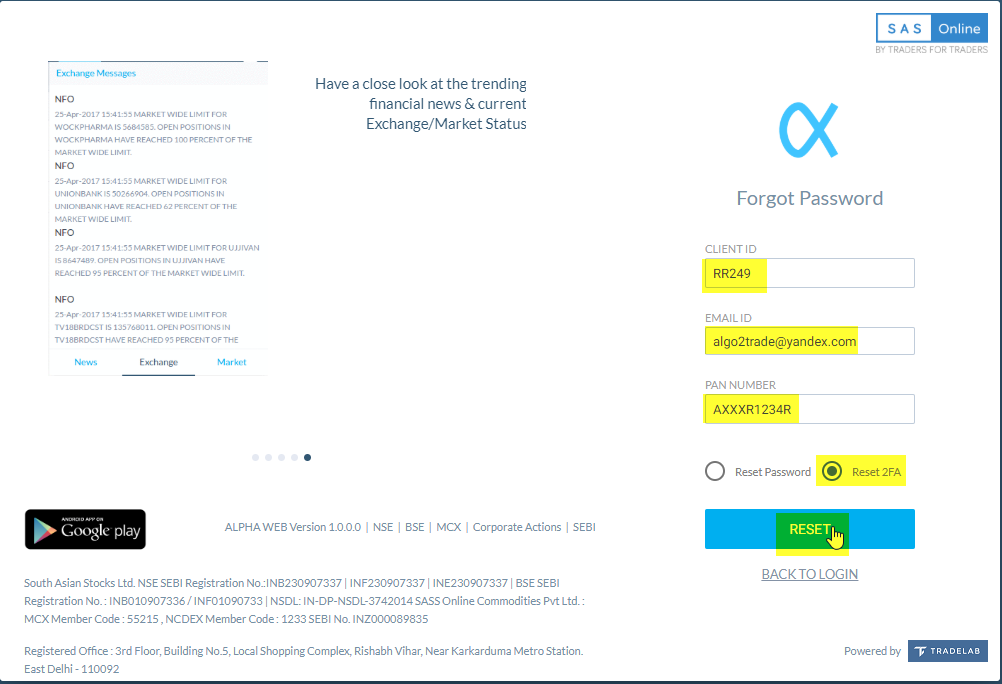

git clone https://github.com/algo2t/alphatrade.gitalphatrade module using pip => python -m pip install https://github.com/algo2t/alphatrade.gitzlogin_example.py file in the editorconfig.py file as per instructions given below and in the above fileFORGET PASSWORD? => Select Reset 2FA radio button.

RESET button.

BACK TO LOGIN and enter CLIENT ID and PASSWORD, click on SECURED SIGN-INSUBMIT button.

config.py

login_id = "XXXXX"

password = "XXXXXXXX"

Totp = 'XXXXXXXXXXXXXXXX'

try:

access_token = open('access_token.txt', 'r').read().rstrip()

except Exception as e:

print('Exception occurred :: {}'.format(e))

access_token = None

Here is an example moving average strategy using alpha trade web API. This strategy generates a buy signal when 5-EMA > 20-EMA (golden cross) or a sell signal when 5-EMA < 20-EMA (death cross).

Here is an example for getting historical data using alpha trade web API.

For historical candles data start_time and end_time must be provided in format as shown below.

It can also be provided as timedelta. Check the script zhistorical_data.py in examples.

from datetime import datetime, timedelta

start_time = datetime(2020, 10, 19, 9, 15, 0)

end_time = datetime(2020, 10, 21, 16, 59, 0)

df = sas.get_historical_candles('MCX', 'NATURALGAS OCT FUT', start_time, end_time, 5)

print(df)

end_time = start_time + timedelta(days=5)

df = sas.get_historical_candles('MCX', 'NATURALGAS NOV FUT', start_time, end_time, 15)

print(df)

For intraday or today‘s / current day‘s candles data.

df = sas.get_intraday_candles('MCX', 'NATURALGAS OCT FUT')

print(df)

df = sas.get_intraday_candles('MCX', 'NATURALGAS NOV FUT', 15)

print(df)

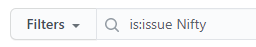

Before creating an issue in this library, please follow the following steps.

is:issue as filter and search your problem.

FAQs

Python APIs for SAS Online Alpha Trade Web Platform

We found that alphatrade demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 1 open source maintainer collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Security News

TC39 advances 11 JavaScript proposals, with two moving to Stage 4, bringing better math, binary APIs, and more features one step closer to the ECMAScript spec.

Research

/Security News

A flawed sandbox in @nestjs/devtools-integration lets attackers run code on your machine via CSRF, leading to full Remote Code Execution (RCE).

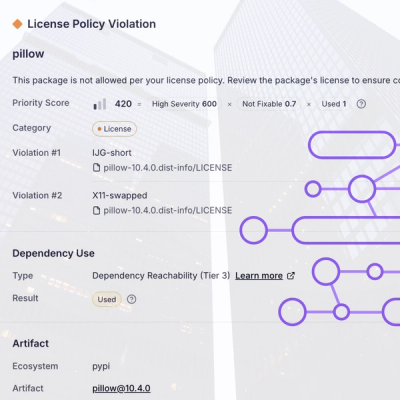

Product

Customize license detection with Socket’s new license overlays: gain control, reduce noise, and handle edge cases with precision.