Research

/Security News

Critical Vulnerability in NestJS Devtools: Localhost RCE via Sandbox Escape

A flawed sandbox in @nestjs/devtools-integration lets attackers run code on your machine via CSRF, leading to full Remote Code Execution (RCE).

Create a virtual environment

virtualenv venv --python=python3

Activate the virtual environment

# Macbook / Linus

source venv/bin/activate

# Windows

venv/Scripts/activate

Deactivate

deactivate

Install AreixIO package

pip install areixio

Define trading strategy:

from areixio import (BacktestBroker,CryptoDataFeed, StockDataFeed, CustomDataFeed,

create_report_folder, Strategy, BackTest, Indicator, Statistic)

from collections import defaultdict

from datetime import datetime

from dateutil.parser import parse

class TestStrategy(Strategy):

boll_window = 18

boll_dev = 3.4

cci_window = 10

atr_window = 30

sl_multiplier = 5.2

def initialize(self):

self.boll_up = defaultdict(float)

self.boll_down = defaultdict(float)

self.cci_value = defaultdict(float)

self.atr_value = defaultdict(float)

self.intra_trade_high = defaultdict(float)

self.intra_trade_low = defaultdict(float)

self.long_stop = defaultdict(float)

self.short_stop = defaultdict(float)

self.indicators = {}

for code, exchange in self.ctx.symbols:

self.indicators[code] = Indicator()

def on_order_fail(self, order):

self.error(f"Order [number {order['order_id']}] [{order['status'].name}]. Msg: {order['msg']}")

def on_order_fill(self, order):

self.info(f"({order.aio_position_id}) - {'OPEN' if order.is_open else 'CLOSE'} {order['side'].name} order [number {order['order_id']}] executed [quantity {order['quantity']}] [price ${order['price']:2f}] [Cost ${order['gross_amount']:2f}] [Commission: ${order['commission']}] [Available balance: ${self.available_balance}] [Position: #{self.ctx.get_quantity(aio_position_id = order['aio_position_id'])}] [Gross P&L: ${order['pnl']}] [Net P&L: ${order['pnl_net']}] ")

if not order['is_open']:

self.info(f"========> Trade closed, pnl: {order['pnl']}")

def on_bar(self, tick):

self.cancel_all()

for code, exchange in self.ctx.symbols:

indicator = self.indicators[code]

bar = self.ctx.get_bar_data(symbol=code, exchange=exchange)

# hist = self.ctx.get_history(symbol=code, exchange=exchange)

if bar is None:

continue

indicator.update_bar(bar=bar)

if not indicator.inited:

continue

close = bar.close

self.boll_up[code], self.boll_down[code] = indicator.boll(self.boll_window, self.boll_dev)

self.cci_value[code] = indicator.cci(self.cci_window)

self.atr_value[code] = indicator.atr(self.atr_window)

self.pos = self.ctx.get_quantity(symbol=code,exchange=exchange )

self.debug(f"pos:{self.pos}; cci_value:{self.cci_value[code]}; atr_value:{self.atr_value[code]}; boll_up:{self.boll_up[code]}; boll_down:{self.boll_down[code]}; intra_trade_high:{self.intra_trade_high[code]}; long_stop:{self.long_stop[code]}; intra_trade_low:{self.intra_trade_low[code]}; short_stop:{self.short_stop[code]}; close:{close}")

order = None

close_order = None

if not self.pos:

self.intra_trade_high[code] = bar.high

self.intra_trade_low[code] = bar.low

if self.cci_value[code] > 0:

order = self.buy(symbol=code, exchange=exchange, stop_price=self.boll_up[code], quantity= self.fixed_size[code])

elif self.cci_value[code] < 0:

order = self.sell(symbol=code, exchange=exchange, stop_price=self.boll_down[code],quantity= self.fixed_size[code])

elif self.pos > 0:

self.intra_trade_high[code] = max(self.intra_trade_high[code], bar.high)

self.intra_trade_low[code] = bar.low

self.long_stop[code] = self.intra_trade_high[code] - self.atr_value[code] * self.sl_multiplier

close_order = self.close(symbol=code, exchange=exchange, stop_price=self.long_stop[code],)

elif self.pos < 0:

self.intra_trade_high[code] = bar.high

self.intra_trade_low[code] = min(self.intra_trade_low[code], bar.low)

self.short_stop[code] = self.intra_trade_low[code] + self.atr_value[code] * self.sl_multiplier

close_order = self.close(symbol=code, exchange=exchange, stop_price=self.short_stop[code],)

if order:

self.info(f"Order for {code} [number {order['order_id']}] ({order['order_type'].name} & {order['side'].name}) created, [quantity {order['quantity']}] [price {order['price']}]")

if close_order:

self.info(f"Stop Order for {code} [number {close_order['order_id']}] ({close_order['order_type']} & {close_order['side'].name}) created, [quantity {close_order['quantity']}] [price {close_order['price']}]")

usage:

if __name__ == '__main__':

benchmark_code = 'BTC/USDT'

interval = '1h'

start_date = "2022-01-01 00:00:00"

end_date = "2022-08-22 00:00:00"

# end_date = datetime.now().strftime("%Y-%m-%d %H:%M:%S")

second_timeframe = {

'start_date': "2022-10-01 00:00:00",

'end_date': datetime.now().strftime("%Y-%m-%d %H:%M:%S"),

'interval': "1m",

}

### uncomment the following if has multiple timeframe

second_timeframe = {}

fixed_size = {

'BTCUSDT': 0.5,

'ETHUSDT': 1,

'SOLUSDT': 5,

}

codes = list(fixed_size.keys())

asset_type = 'perpetual'

exchange = 'bybit'

base = create_report_folder()

if isinstance(codes, str):

codes = [codes]

feeds = []

for code in codes:

df = CryptoDataFeed(

code=code,

exchange=exchange,

asset_type = asset_type,

start_date=start_date,

end_date=end_date,

interval=interval,

order_ascending=True,

# store_path=base

)

df.fetch_info()

### uncomment the following if has multiple timeframe

# if second_timeframe:

# hist_data = df.fetch_hist(start=parse(second_timeframe['start_date']), end=parse(second_timeframe['end_date']), interval=second_timeframe['interval'], is_store=True)

# df.update_data(hist_data)

feeds.append(df)

benchmark = CryptoDataFeed(

code=benchmark_code,

exchange=exchange,

asset_type = asset_type,

start_date=start_date,

end_date=end_date,

interval=interval,

min_volume = 0.00001,

order_ascending=True,

# store_path=base

)

### uncomment the following if has multiple timeframe

# if second_timeframe:

# hist_data = benchmark.fetch_hist(start=parse(second_timeframe['start_date']), end=parse(second_timeframe['end_date']), interval=second_timeframe['interval'], is_store=True)

# benchmark.update_data(hist_data)

broker = BacktestBroker(

balance=100_000,

short_cash=False,

slippage=0.0)

trade_history = []

statistic = Statistic()

mytest = BackTest(

feeds,

TestStrategy,

statistic=statistic,

benchmark=benchmark,

store_path=base,

broker=broker,

backtest_mode='bar',

fixed_size = fixed_size,

trade_history=trade_history

)

mytest.start()

stats = mytest.ctx.statistic.stats(interval=interval)

stats['algorithm'] = ['Bollinger Band', 'CCI', 'ATR']

print(stats)

mytest.ctx.statistic.contest_output(path=base, interval=interval, prefix=f'bt_',is_plot=True)

Result:

start 2022-01-01 00:00:00+08:00

end 2022-08-22 00:00:00+08:00

interval 1h

duration 233 days 00:00:00

trading_instruments [BTCUSDT, ETHUSDT, SOLUSDT]

base_currency USDT

benchmark BTCUSDT

beginning_balance 100000

ending_balance 119562.812570

available_balance 117927.612569

holding_values 1635.200000

capital 100000

additional_capitals {}

net_investment 27960.225000

total_net_profit 19562.812570

total_commission 14.107925

gross_profit 209249.519700

gross_loss -189686.707100

profit_factor 1.103132

return_on_capital 0.195628

return_on_initial_capital 0.195628

return_on_investment 0.699666

annualized_return 0.322989

total_return 0.195628

max_return 0.199261

min_return 0.000000

past_24hr_pnl -61.800000

past_24hr_roi -0.000517

past_24hr_apr -0.188705

number_trades 457

number_closed_trades 227

number_winning_trades 100

number_losing_trades 127

avg_daily_trades 2.840000

avg_weekly_trades 13.850000

avg_monthly_trades 57.130000

win_ratio 0.440529

loss_ratio 0.559471

gross_trades_profit 40851.052400

gross_trades_loss -19646.301700

gross_winning_trades_amount 623690.417300

gross_losing_trades_amount 1002871.039600

avg_winning_trades_pnl 408.510524

avg_losing_trades_pnl -154.695289

avg_winning_trades_amount 6236.904173

avg_losing_trades_amount 4910.948168

largest_profit_winning_trade 4735.210100

largest_loss_losing_trade -1039.239400

avg_amount_per_closed_trade 7165.469000

expected_value 93.410000

standardized_expected_value 14.980000

win_days 106

loss_days 113

max_win_in_day 394.250000

max_loss_in_day -532.521400

max_consecutive_win_days 6

max_consecutive_loss_days 6

avg_profit_per_trade($) 93.413000

avg_profit_per_trade 0.000900

trading_period 0 years 7 months 21 days 0 hours

avg_daily_pnl($) 83.960600

avg_daily_pnl 0.000781

avg_weekly_pnl($) 575.376900

avg_weekly_pnl 0.005363

avg_monthly_pnl($) 2454.108200

avg_monthly_pnl 0.022597

avg_quarterly_pnl($) 5512.129000

avg_quarterly_pnl 0.049787

avg_annualy_pnl($) None

avg_annualy_pnl None

var 180.327500

risk_score 0.190000

avg_daily_risk_score 0.210000

avg_risk_score_past_7days 0.190000

monthly_avg_risk_score {'2022-01-31 23:00:00': 0.18, '2022-02-28 23:0...

frequently_traded [{'symbol': 'BTCUSDT', 'asset_type': 'PERPETUA...

sharpe_ratio 2.728096

sortino_ratio 4.154441

annualized_volatility 0.104470

omega_ratio 1.104314

downside_risk 0.068596

information_ratio 0.018749

beta -0.048020

alpha 0.266868

calmar_ratio 8.375185

tail_ratio 1.115830

stability_of_timeseries 0.954381

max_drawdown 0.038565

max_drawdown_period (2022-05-12 14:00:00+08:00, 2022-05-30 03:00:0...

max_drawdown_duration 17 days 13:00:00

sqn 2.286010

monthly_changes {'2022-01-31 00:00:00': 0.0, '2022-02-28 00:00...

daily_changes {'2022-01-01 00:00:00': 0.0, '2022-01-02 00:00...

positions [PositionData(symbol='SOLUSDT', code='SOLUSDT'...

trades [TradeData(order_id='220106-000000000-00066', ...

pnl [{'available_balance': 100000.0, 'holding_valu...

Optimization:

if __name__ == '__main__':

benchmark_code = 'BTC/USDT'

interval = '1h'

start_date="2022-08-01 00:00:00"

end_date= datetime.now().strftime("%Y-%m-%d %H:%M:%S")

.....

mytest = BackTest(

feeds,

TestStrategy,

benchmark=benchmark,

store_path=base,

broker=broker,

exchange=exchange,

fixed_size = fixed_size,

# trade_history=trade_history

do_print=False ### in case print too much log

)

ostats = mytest.optimize(

boll_window=[13,18,22],

boll_dev=[3,3.4,3.8],

# cci_window=[8,10,12],

# atr_window=[28,30,32],

sl_multiplier=[4.8,5.2,5.6],

maximize='total_net_profit',

constraint=None,

return_heatmap=True

)

print('ostats',ostats)

Result:

Name: value, dtype: object, boll_window boll_dev sl_multiplier

13 3.000000 4.800000 636.305780

5.200000 974.743960

5.600000 984.011120

3.400000 4.800000 555.828790

5.200000 715.990480

5.600000 779.417500

3.800000 4.800000 19.314340

5.200000 564.115470

5.600000 564.979500

18 3.000000 4.800000 -156.087610

5.200000 785.291570

5.600000 867.817680

3.400000 4.800000 910.641420

5.200000 1366.349790

5.600000 1567.919300

3.800000 4.800000 237.782640

5.200000 547.324610

5.600000 813.536520

22 3.000000 4.800000 839.132020

5.200000 1274.691530

5.600000 1401.274140

3.400000 4.800000 345.991700

5.200000 966.018210

5.600000 1105.940740

3.800000 4.800000 522.481170

5.200000 1030.565530

5.600000 782.557010

Indicator requires to install ta-lib

Mac:

1.1 Install TA-LIB

brew install ta-lib

1.2 Install TA-LIB Python Wrapper

Install TA-Lib Python Wrapper via pip (or pip3):

pip install ta-lib

Linux:

1.1 Download

wget http://prdownloads.sourceforge.net/ta-lib/ta-lib-0.4.0-src.tar.gz

tar -xzf ta-lib-0.4.0-src.tar.gz

cd ta-lib/

1.2 Install TA-LIB

If the next command fails, then gcc is missing, install it by doing “apt-get install build-essential”)

sudo ./configure

sudo make

sudo make install

if configure error: cannot guess build type you must specify one

This was solved for me by specifying the --build= parameter during the ./configure step.

For arm64

./configure --build=aarch64-unknown-linux-gnu

For x86

./configure --build=x86_64-unknown-linux-gnu

1.3 Install TA-LIB Python Wrapper

Install TA-Lib Python Wrapper via pip (or pip3):

pip install ta-lib

Windows

1.1 Download

Download [ta-lib-0.4.0-msvc.zip](http://prdownloads.sourceforge.net/ta-lib/ta-lib-0.4.0-msvc.zip)

1.2 Unzip

unzip to C:\ta-lib

1.3 Install TA-LIB Python Wrapper

Install TA-Lib Python Wrapper via pip (or pip3):

pip install ta-lib

FAQs

Areix IO Backtesting Framework

We found that areixio demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 1 open source maintainer collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Research

/Security News

A flawed sandbox in @nestjs/devtools-integration lets attackers run code on your machine via CSRF, leading to full Remote Code Execution (RCE).

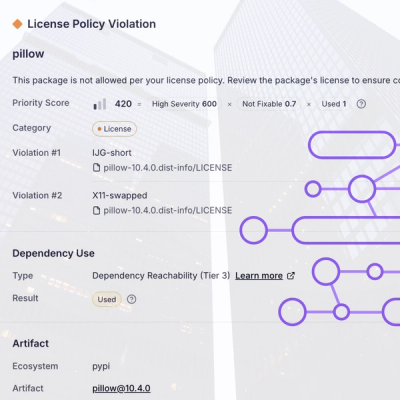

Product

Customize license detection with Socket’s new license overlays: gain control, reduce noise, and handle edge cases with precision.

Product

Socket now supports Rust and Cargo, offering package search for all users and experimental SBOM generation for enterprise projects.