Security News

Static vs. Runtime Reachability: Insights from Latio’s On the Record Podcast

The Latio podcast explores how static and runtime reachability help teams prioritize exploitable vulnerabilities and streamline AppSec workflows.

coinmetrics-api-client

Advanced tools

The Coin Metrics Python API Client is the official Python wrapper for the Coin Metrics API, allowing you to access Coin Metrics data using Python. In just a few lines of code, anyone can access clean cryptocurrency data in a familiar form, such as a pandas dataframe.

This tool offers the following convenient features over simply using requests to query the Coin Metrics API:

To install the client you can run the following command:

pip install coinmetrics-api-client

Note that the client is updated regularly to reflect the changes made in API v4. Ensure that your latest version matches with what's in pyPI

To update your version, run the following command:

pip install coinmetrics-api-client -U

To initialize the client you should use your API key, and the CoinMetricsClient class like the following.

from coinmetrics.api_client import CoinMetricsClient

import os

# we recommend storing your Coin Metrics API key in an environment variable

api_key = os.environ.get("CM_API_KEY")

client = CoinMetricsClient(api_key)

# or to use community API:

client = CoinMetricsClient()

FAQs

Python client for Coin Metrics API v4.

We found that coinmetrics-api-client demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 3 open source maintainers collaborating on the project.

Did you know?

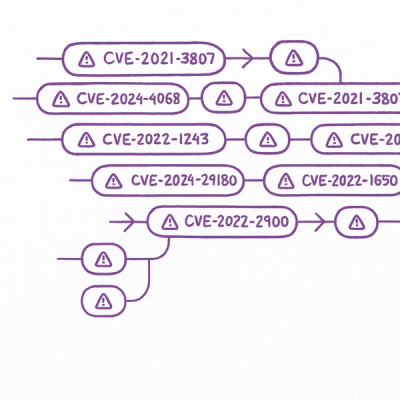

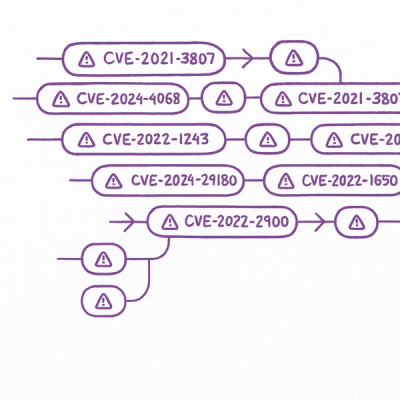

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Security News

The Latio podcast explores how static and runtime reachability help teams prioritize exploitable vulnerabilities and streamline AppSec workflows.

Security News

The latest Opengrep releases add Apex scanning, precision rule tuning, and performance gains for open source static code analysis.

Security News

npm now supports Trusted Publishing with OIDC, enabling secure package publishing directly from CI/CD workflows without relying on long-lived tokens.