Research

Security News

Lazarus Strikes npm Again with New Wave of Malicious Packages

The Socket Research Team has discovered six new malicious npm packages linked to North Korea’s Lazarus Group, designed to steal credentials and deploy backdoors.

fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics

Advanced tools

S&P Global Fixed Income Evaluated Prices and Analytics client library for Python

Gain access to evaluated pricing and analytics data for Corporate Bonds, Municipal Bonds and Asset Backed Securities provided by S&P Global (formerly IHS Markit) .

Data returned through multiple endpoints like prices, spread, yield, yield curve, sensitivity, coupon information, securities metadata and details specific to the Asset Backed Securities.

This Python package is automatically generated by the OpenAPI Generator project:

For more information, please visit https://developer.factset.com/contact

poetry add fds.sdk.utils fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics==0.1.13

pip install fds.sdk.utils fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics==0.1.13

Install and activate python 3.7+. If you're using pyenv:

pyenv install 3.9.7

pyenv shell 3.9.7

(optional) Install poetry.

[!IMPORTANT] The parameter variables defined below are just examples and may potentially contain non valid values. Please replace them with valid values.

from fds.sdk.utils.authentication import ConfidentialClient

import fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics

from fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.api import abs_details_api

from fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.models import *

from dateutil.parser import parse as dateutil_parser

from pprint import pprint

# See configuration.py for a list of all supported configuration parameters.

# Examples for each supported authentication method are below,

# choose one that satisfies your use case.

# (Preferred) OAuth 2.0: FactSetOAuth2

# See https://github.com/FactSet/enterprise-sdk#oauth-20

# for information on how to create the app-config.json file

#

# The confidential client instance should be reused in production environments.

# See https://github.com/FactSet/enterprise-sdk-utils-python#authentication

# for more information on using the ConfidentialClient class

configuration = fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.Configuration(

fds_oauth_client=ConfidentialClient('/path/to/app-config.json')

)

# Basic authentication: FactSetApiKey

# See https://github.com/FactSet/enterprise-sdk#api-key

# for information how to create an API key

# configuration = fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.Configuration(

# username='USERNAME-SERIAL',

# password='API-KEY'

# )

# Enter a context with an instance of the API client

with fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.ApiClient(configuration) as api_client:

# Create an instance of the API class

api_instance = abs_details_api.ABSDetailsApi(api_client)

ids = ["US05522RDC97"] # [str] | Security or Entity identifiers. FactSet Identifiers, tickers, CUSIP, ISIN and SEDOL are accepted as input. <p>***ids limit** = 2000 per request*</p> *<p>Make note, GET Method URL request lines are also limited to a total length of 8192 bytes (8KB). In cases where the service allows for thousands of ids, which may lead to exceeding this request line limit of 8KB, its advised for any requests with large request lines to be requested through the respective \"POST\" method.</p>*

start_date = "2021-01-01" # str | The start date requested for a given date range in **YYYY-MM-DD** format. If left blank, the API will default to previous close. Future dates (T+1) are not accepted in this endpoint. (optional)

end_date = "2021-12-31" # str | The end date requested for a given date range in **YYYY-MM-DD** format. If left blank, the API will default to previous close. Future dates (T+1) are not accepted in this endpoint. (optional)

frequency = "D" # str | Controls the display frequency of the data returned. * **D** = Daily * **W** = Weekly, based on the last day of the week of the start date. * **M** = Monthly, based on the last trading day of the month. * **AM** = Monthly, based on the start date (e.g., if the start date is June 16, data is displayed for June 16, May 16, April 16 etc.). * **CQ** = Quarterly based on the last trading day of the calendar quarter (March, June, September, or December). * **FQ** = Fiscal Quarter of the company. * **AY** = Actual Annual, based on the start date. * **CY** = Calendar Annual, based on the last trading day of the calendar year. * **FY** = Fiscal Annual, based on the last trading day of the company's fiscal year. (optional) if omitted the server will use the default value of "D"

calendar = "FIVEDAY" # str | Calendar of data returned. SEVENDAY includes weekends. LOCAL calendar will default to the securities' trading calendar which excludes date records for respective holiday periods. (optional) if omitted the server will use the default value of "FIVEDAY"

try:

# Get Asset Backed Security Details for a list of securities

# example passing only required values which don't have defaults set

# and optional values

api_response = api_instance.get_abs_details(ids, start_date=start_date, end_date=end_date, frequency=frequency, calendar=calendar)

pprint(api_response)

except fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.ApiException as e:

print("Exception when calling ABSDetailsApi->get_abs_details: %s\n" % e)

# # Get response, http status code and response headers

# try:

# # Get Asset Backed Security Details for a list of securities

# api_response, http_status_code, response_headers = api_instance.get_abs_details_with_http_info(ids, start_date=start_date, end_date=end_date, frequency=frequency, calendar=calendar)

# pprint(api_response)

# pprint(http_status_code)

# pprint(response_headers)

# except fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.ApiException as e:

# print("Exception when calling ABSDetailsApi->get_abs_details: %s\n" % e)

# # Get response asynchronous

# try:

# # Get Asset Backed Security Details for a list of securities

# async_result = api_instance.get_abs_details_async(ids, start_date=start_date, end_date=end_date, frequency=frequency, calendar=calendar)

# api_response = async_result.get()

# pprint(api_response)

# except fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.ApiException as e:

# print("Exception when calling ABSDetailsApi->get_abs_details: %s\n" % e)

# # Get response, http status code and response headers asynchronous

# try:

# # Get Asset Backed Security Details for a list of securities

# async_result = api_instance.get_abs_details_with_http_info_async(ids, start_date=start_date, end_date=end_date, frequency=frequency, calendar=calendar)

# api_response, http_status_code, response_headers = async_result.get()

# pprint(api_response)

# pprint(http_status_code)

# pprint(response_headers)

# except fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.ApiException as e:

# print("Exception when calling ABSDetailsApi->get_abs_details: %s\n" % e)

To convert an API response to a Pandas DataFrame, it is necessary to transform it first to a dictionary.

import pandas as pd

response_dict = api_response.to_dict()['data']

simple_json_response = pd.DataFrame(response_dict)

nested_json_response = pd.json_normalize(response_dict)

The SDK uses the standard library logging module.

Setting debug to True on an instance of the Configuration class sets the log-level of related packages to DEBUG

and enables additional logging in Pythons HTTP Client.

Note: This prints out sensitive information (e.g. the full request and response). Use with care.

import logging

import fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics

logging.basicConfig(level=logging.DEBUG)

configuration = fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.Configuration(...)

configuration.debug = True

You can pass proxy settings to the Configuration class:

proxy: The URL of the proxy to use.proxy_headers: a dictionary to pass additional headers to the proxy (e.g. Proxy-Authorization).import fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics

configuration = fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.Configuration(

# ...

proxy="http://secret:password@localhost:5050",

proxy_headers={

"Custom-Proxy-Header": "Custom-Proxy-Header-Value"

}

)

TLS/SSL certificate verification can be configured with the following Configuration parameters:

ssl_ca_cert: a path to the certificate to use for verification in PEM format.verify_ssl: setting this to False disables the verification of certificates.

Disabling the verification is not recommended, but it might be useful during

local development or testing.import fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics

configuration = fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.Configuration(

# ...

ssl_ca_cert='/path/to/ca.pem'

)

In case the request retry behaviour should be customized, it is possible to pass a urllib3.Retry object to the retry property of the Configuration.

from urllib3 import Retry

import fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics

configuration = fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.Configuration(

# ...

)

configuration.retries = Retry(total=3, status_forcelist=[500, 502, 503, 504])

All URIs are relative to https://api.factset.com/content

| Class | Method | HTTP request | Description |

|---|---|---|---|

| ABSDetailsApi | get_abs_details | GET /markit-bond-prices-and-analytics/v1/abs-details | Get Asset Backed Security Details for a list of securities |

| ABSDetailsApi | get_abs_details_for_list | POST /markit-bond-prices-and-analytics/v1/abs-details | Request Asset Backed Security Details for a list of securities |

| CouponApi | get_bond_coupon | GET /markit-bond-prices-and-analytics/v1/coupon | Get coupon data for given date range and list of securities |

| CouponApi | get_bond_coupon_for_list | POST /markit-bond-prices-and-analytics/v1/coupon | Request coupon data for given date range and list of securities |

| IssuerYieldCurveApi | get_bond_issuer_yield_curve | GET /markit-bond-prices-and-analytics/v1/issuer-yield-curve | Get yield curve data for given date range and list of securities |

| IssuerYieldCurveApi | get_bond_issuer_yield_curve_for_list | POST /markit-bond-prices-and-analytics/v1/issuer-yield-curve | Request yield curve data for given date range and list of securities |

| MetaApi | get_bond_meta | GET /markit-bond-prices-and-analytics/v1/meta | Get bond meta data for a list of securities. |

| MetaApi | get_bond_meta_for_list | POST /markit-bond-prices-and-analytics/v1/meta | Get bond meta data for a list of securities. |

| PricesApi | get_bond_prices | GET /markit-bond-prices-and-analytics/v1/prices | Get Bid, Mid and Ask prices for a list of securities |

| PricesApi | get_bond_prices_for_list | POST /markit-bond-prices-and-analytics/v1/prices | Request Bid, Mid and Ask prices for a list of securities |

| SensitivityApi | get_bond_sensitivity | GET /markit-bond-prices-and-analytics/v1/sensitivity | Get the bond sensitivity data for a list of securities |

| SensitivityApi | get_bond_sensitivity_for_list | POST /markit-bond-prices-and-analytics/v1/sensitivity | Request the bond sensitivity data for a list of securities |

| SpreadApi | get_bond_spread | GET /markit-bond-prices-and-analytics/v1/spread | Get the Spread and OAS data for a list of securities |

| SpreadApi | get_bond_spread_for_list | POST /markit-bond-prices-and-analytics/v1/spread | Request the Spread and OAS data for a list of securities |

| YieldApi | get_bond_yield | GET /markit-bond-prices-and-analytics/v1/yield | Get yield information for given date range and list of securities |

| YieldApi | get_bond_yield_for_list | POST /markit-bond-prices-and-analytics/v1/yield | Request yield information for given date range and list of securities |

If the OpenAPI document is large, imports in fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.apis and fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.models may fail with a RecursionError indicating the maximum recursion limit has been exceeded. In that case, there are a couple of solutions:

Solution 1: Use specific imports for apis and models like:

from fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.api.default_api import DefaultApifrom fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.model.pet import PetSolution 2: Before importing the package, adjust the maximum recursion limit as shown below:

import sys

sys.setrecursionlimit(1500)

import fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics

from fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.apis import *

from fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics.models import *

Please refer to the contributing guide.

Copyright 2022 FactSet Research Systems Inc

Licensed under the Apache License, Version 2.0 (the "License"); you may not use this file except in compliance with the License. You may obtain a copy of the License at

http://www.apache.org/licenses/LICENSE-2.0

Unless required by applicable law or agreed to in writing, software distributed under the License is distributed on an "AS IS" BASIS, WITHOUT WARRANTIES OR CONDITIONS OF ANY KIND, either express or implied. See the License for the specific language governing permissions and limitations under the License.

FAQs

S&amp;P Global Fixed Income Evaluated Prices and Analytics client library for Python

We found that fds.sdk.SPGlobalFixedIncomeEvaluatedPricesandAnalytics demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 1 open source maintainer collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Research

Security News

The Socket Research Team has discovered six new malicious npm packages linked to North Korea’s Lazarus Group, designed to steal credentials and deploy backdoors.

Security News

Socket CEO Feross Aboukhadijeh discusses the open web, open source security, and how Socket tackles software supply chain attacks on The Pair Program podcast.

Security News

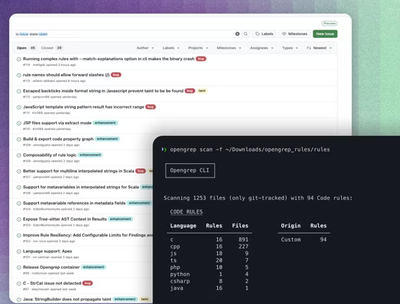

Opengrep continues building momentum with the alpha release of its Playground tool, demonstrating the project's rapid evolution just two months after its initial launch.