Research

/Security News

Critical Vulnerability in NestJS Devtools: Localhost RCE via Sandbox Escape

A flawed sandbox in @nestjs/devtools-integration lets attackers run code on your machine via CSRF, leading to full Remote Code Execution (RCE).

RiskOptima is a powerful Python toolkit for financial risk analysis, portfolio optimization, and advanced quantitative modeling. It integrates state-of-the-art methodologies, including Monte Carlo simulations, Value at Risk (VaR), Conditional VaR (CVaR), Black-Scholes, Heston, and Merton Jump Diffusion models, to aid investors in making data-driven investment decisions.

RiskOptima is a comprehensive Python toolkit for evaluating, managing, and optimizing investment portfolios. This package is designed to empower investors and data scientists by combining financial risk analysis, backtesting, mean-variance optimization, and machine learning capabilities into a single, cohesive package.

https://pypistats.org/packages/riskoptima

See the project here: https://pypi.org/project/riskoptima/

pip install riskoptima

Create your portfolio table similar to the below:

| Asset | Weight | Label | MarketCap |

|---|---|---|---|

| MO | 0.04 | Altria Group Inc. | 110.0e9 |

| NWN | 0.14 | Northwest Natural Gas | 1.8e9 |

| BKH | 0.01 | Black Hills Corp. | 4.5e9 |

| ED | 0.01 | Con Edison | 30.0e9 |

| PEP | 0.09 | PepsiCo Inc. | 255.0e9 |

| NFG | 0.16 | National Fuel Gas | 5.6e9 |

| KO | 0.06 | Coca-Cola Company | 275.0e9 |

| FRT | 0.28 | Federal Realty Inv. Trust | 9.8e9 |

| GPC | 0.16 | Genuine Parts Co. | 25.3e9 |

| MSEX | 0.05 | Middlesex Water Co. | 2.4e9 |

import pandas as pd

from riskoptima import RiskOptima

import warnings

warnings.filterwarnings(

"ignore",

category=FutureWarning,

message=".*DataFrame.std with axis=None is deprecated.*"

)

# Define your current porfolio with your weights and company names

asset_data = [

{"Asset": "MO", "Weight": 0.04, "Label": "Altria Group Inc.", "MarketCap": 110.0e9},

{"Asset": "NWN", "Weight": 0.14, "Label": "Northwest Natural Gas", "MarketCap": 1.8e9},

{"Asset": "BKH", "Weight": 0.01, "Label": "Black Hills Corp.", "MarketCap": 4.5e9},

{"Asset": "ED", "Weight": 0.01, "Label": "Con Edison", "MarketCap": 30.0e9},

{"Asset": "PEP", "Weight": 0.09, "Label": "PepsiCo Inc.", "MarketCap": 255.0e9},

{"Asset": "NFG", "Weight": 0.16, "Label": "National Fuel Gas", "MarketCap": 5.6e9},

{"Asset": "KO", "Weight": 0.06, "Label": "Coca-Cola Company", "MarketCap": 275.0e9},

{"Asset": "FRT", "Weight": 0.28, "Label": "Federal Realty Inv. Trust", "MarketCap": 9.8e9},

{"Asset": "GPC", "Weight": 0.16, "Label": "Genuine Parts Co.", "MarketCap": 25.3e9},

{"Asset": "MSEX", "Weight": 0.05, "Label": "Middlesex Water Co.", "MarketCap": 2.4e9}

]

asset_table = pd.DataFrame(asset_data)

capital = 100_000

asset_table['Portfolio'] = asset_table['Weight'] * capital

ANALYSIS_START_DATE = RiskOptima.get_previous_year_date(RiskOptima.get_previous_working_day(), 1)

ANALYSIS_END_DATE = RiskOptima.get_previous_working_day()

BENCHMARK_INDEX = 'SPY'

RISK_FREE_RATE = 0.05

NUMBER_OF_WEIGHTS = 10_000

NUMBER_OF_MC_RUNS = 1_000

If you want to know visually how's your portfolio doing right now

RiskOptima.create_portfolio_area_chart(

asset_table,

end_date=ANALYSIS_END_DATE,

lookback_days=2,

title="Portfolio Area Chart"

)

RiskOptima.plot_efficient_frontier_monte_carlo(

asset_table,

start_date=ANALYSIS_START_DATE,

end_date=ANALYSIS_END_DATE,

risk_free_rate=RISK_FREE_RATE,

num_portfolios=NUMBER_OF_WEIGHTS,

market_benchmark=BENCHMARK_INDEX,

set_ticks=False,

x_pos_table=1.15, # Position for the weight table on the plot

y_pos_table=0.52, # Position for the weight table on the plot

title=f'Efficient Frontier - Monte Carlo Simulation {ANALYSIS_START_DATE} to {ANALYSIS_END_DATE}'

)

RiskOptima.run_portfolio_optimization_mv_ml(

asset_table=asset_table,

training_start_date='2022-01-01',

training_end_date='2023-11-27',

model_type='Linear Regression',

risk_free_rate=RISK_FREE_RATE,

num_portfolios=100000,

market_benchmark=[BENCHMARK_INDEX],

max_volatility=0.25,

min_weight=0.03,

max_weight=0.2

)

RiskOptima.run_portfolio_probability_analysis(

asset_table=asset_table,

analysis_start_date=ANALYSIS_START_DATE,

analysis_end_date=ANALYSIS_END_DATE,

benchmark_index=BENCHMARK_INDEX,

risk_free_rate=RISK_FREE_RATE,

number_of_portfolio_weights=NUMBER_OF_WEIGHTS,

trading_days_per_year=RiskOptima.get_trading_days(),

number_of_monte_carlo_runs=NUMBER_OF_MC_RUNS

)

from riskoptima import RiskOptima

cf = RiskOptima.bond_cash_flows_v2(4, 1000, 0.06, 2) # 2 years, semi-annual, hence 4 periods

md_2 = RiskOptima.macaulay_duration_v3(cf, 0.05, 2)

md_2

ANALYSIS_START_DATE = RiskOptima.get_previous_year_date(RiskOptima.get_previous_working_day(), 1)

ANALYSIS_END_DATE = RiskOptima.get_previous_working_day()

df_signals, df_exits, returns = RiskOptima.run_index_vol_divergence_signals(start_date=ANALYSIS_START_DATE,

end_date=ANALYSIS_END_DATE)

For complete documentation and usage examples, visit the GitHub repository:

We welcome contributions! If you'd like to improve the package or report issues, please visit the GitHub repository.

RiskOptima is licensed under the MIT License.

FAQs

RiskOptima is a powerful Python toolkit for financial risk analysis, portfolio optimization, and advanced quantitative modeling. It integrates state-of-the-art methodologies, including Monte Carlo simulations, Value at Risk (VaR), Conditional VaR (CVaR), Black-Scholes, Heston, and Merton Jump Diffusion models, to aid investors in making data-driven investment decisions.

We found that riskoptima demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 1 open source maintainer collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Research

/Security News

A flawed sandbox in @nestjs/devtools-integration lets attackers run code on your machine via CSRF, leading to full Remote Code Execution (RCE).

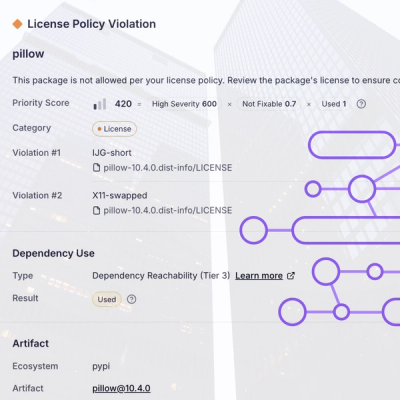

Product

Customize license detection with Socket’s new license overlays: gain control, reduce noise, and handle edge cases with precision.

Product

Socket now supports Rust and Cargo, offering package search for all users and experimental SBOM generation for enterprise projects.