Research

/Security News

Critical Vulnerability in NestJS Devtools: Localhost RCE via Sandbox Escape

A flawed sandbox in @nestjs/devtools-integration lets attackers run code on your machine via CSRF, leading to full Remote Code Execution (RCE).

stacking-sats-pipeline

Advanced tools

A data engineering pipeline for extracting, loading, and merging cryptocurrency and financial data from multiple sources.

pip install stacking-sats-pipeline

Extract all data sources to local files for offline analysis:

# Extract all data to CSV format

stacking-sats --extract-data csv

# Extract all data to Parquet format (smaller files, better compression)

stacking-sats --extract-data parquet

# Extract to specific directory

stacking-sats --extract-data csv --output-dir data/

stacking-sats --extract-data parquet -o exports/

from stacking_sats_pipeline import extract_all_data

# Extract all data to CSV in current directory

extract_all_data("csv")

# Extract all data to Parquet in specific directory

extract_all_data("parquet", "data/exports/")

from stacking_sats_pipeline import load_data

# Load Bitcoin price data

df = load_data()

# Load specific data source

from stacking_sats_pipeline.data import CoinMetricsLoader

loader = CoinMetricsLoader()

btc_data = loader.load_from_web()

What gets extracted:

btc_coinmetrics.csv/parquetfear_greed.csv/parquetdxy_fred.csv/parquet**Requires FRED_API_KEY environment variable. Get a free key at FRED API

File Format Benefits:

from stacking_sats_pipeline.data import MultiSourceDataLoader

# Load and merge data from all available sources

loader = MultiSourceDataLoader()

available_sources = loader.get_available_sources()

merged_df = loader.load_and_merge(available_sources)

# Available sources: coinmetrics, feargreed, fred (if API key available)

print(f"Available data sources: {available_sources}")

print(f"Merged data shape: {merged_df.shape}")

from stacking_sats_pipeline.data import CoinMetricsLoader

loader = CoinMetricsLoader(data_dir="data/")

df = loader.load_from_web() # Fetch latest data

df = loader.load_from_file() # Load cached data (fetches if missing)

# Extract to files

csv_path = loader.extract_to_csv()

parquet_path = loader.extract_to_parquet()

from stacking_sats_pipeline.data import FearGreedLoader

loader = FearGreedLoader(data_dir="data/")

df = loader.load_from_web()

import os

os.environ['FRED_API_KEY'] = 'your_api_key_here'

from stacking_sats_pipeline.data import FREDLoader

loader = FREDLoader(data_dir="data/")

df = loader.load_from_web() # DXY (Dollar Index) data

For development and testing:

Requirements: Python 3.11 or 3.12

# Clone the repository

git clone https://github.com/hypertrial/stacking_sats_pipeline.git

cd stacking_sats_pipeline

# Set up development environment (installs dependencies + pre-commit hooks)

make setup-dev

# OR manually:

pip install -e ".[dev]"

pre-commit install

# Run tests

make test

# OR: pytest

# Code quality (MANDATORY - CI will fail if not clean)

make lint # Fix linting issues

make format # Format code

make check # Check without fixing (CI-style)

# Run specific test categories

pytest -m "not integration" # Skip integration tests

pytest -m integration # Run only integration tests

⚠️ MANDATORY: All code must pass ruff linting and formatting checks.

Quick commands:

make help # Show all available commands

make lint # Fix ALL issues (autopep8 + ruff + format)

make autopep8 # Fix line length issues specifically

make format # Format code with ruff only

make format-all # Comprehensive formatting (autopep8 + ruff)

make check # Check code quality (what CI runs)

For detailed testing documentation, see TESTS.md.

The data loading system is designed to be modular and extensible. To add new data sources (exchanges, APIs, etc.), see the Data Loader Contribution Guide which provides step-by-step instructions for implementing new data loaders.

# Extract data

stacking-sats --extract-data csv --output-dir data/

stacking-sats --extract-data parquet -o exports/

# Show help

stacking-sats --help

├── stacking_sats_pipeline/

│ ├── main.py # Pipeline orchestrator and CLI

│ ├── config.py # Configuration constants

│ ├── data/ # Modular data loading system

│ │ ├── coinmetrics_loader.py # CoinMetrics data source

│ │ ├── fear_greed_loader.py # Fear & Greed Index data source

│ │ ├── fred_loader.py # FRED economic data source

│ │ ├── data_loader.py # Multi-source data loader

│ │ └── CONTRIBUTE.md # Guide for adding data sources

│ └── __init__.py # Package exports

├── tutorials/examples.py # Interactive examples

└── tests/ # Comprehensive test suite

from stacking_sats_pipeline import (

extract_all_data, # Extract all data sources to files

load_data, # Load Bitcoin price data

validate_price_data, # Validate price data quality

extract_btc_data_to_csv, # Extract Bitcoin data to CSV

extract_btc_data_to_parquet # Extract Bitcoin data to Parquet

)

from stacking_sats_pipeline import (

BACKTEST_START, # Default start date for data range

BACKTEST_END, # Default end date for data range

CYCLE_YEARS, # Default cycle period

MIN_WEIGHT, # Minimum weight threshold

PURCHASE_FREQ # Default purchase frequency

)

All data sources include built-in validation:

from stacking_sats_pipeline import validate_price_data

# Validate Bitcoin price data

df = load_data()

is_valid = validate_price_data(df)

# Custom validation with specific requirements

requirements = {

'required_columns': ['PriceUSD', 'Volume'],

'min_price': 100,

'max_price': 1000000

}

is_valid = validate_price_data(df, **requirements)

The pipeline supports both CSV and Parquet formats:

# CSV format

extract_all_data("csv", "output_dir/")

# Parquet format

extract_all_data("parquet", "output_dir/")

All data sources normalize timestamps to midnight UTC for consistent merging:

loader = MultiSourceDataLoader()

merged_df = loader.load_and_merge(['coinmetrics', 'fred'])

# All timestamps are normalized to 00:00:00 UTC

print(merged_df.index.tz) # UTC

print(merged_df.index.time[0]) # 00:00:00

The pipeline includes comprehensive error handling:

try:

df = extract_all_data("csv")

except Exception as e:

print(f"Data extraction failed: {e}")

# Partial extraction may have succeeded

Individual data sources fail gracefully - if one source is unavailable, others will still be extracted.

FAQs

Hypertrial's Stacking Sats Library - Optimized Bitcoin DCA

We found that stacking-sats-pipeline demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 1 open source maintainer collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Research

/Security News

A flawed sandbox in @nestjs/devtools-integration lets attackers run code on your machine via CSRF, leading to full Remote Code Execution (RCE).

Product

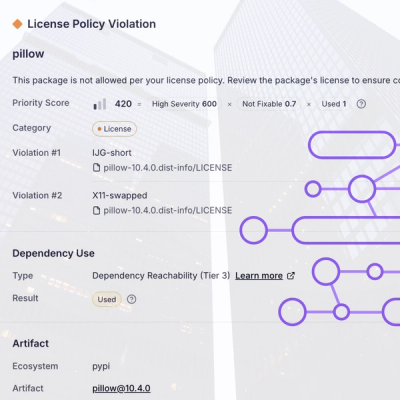

Customize license detection with Socket’s new license overlays: gain control, reduce noise, and handle edge cases with precision.

Product

Socket now supports Rust and Cargo, offering package search for all users and experimental SBOM generation for enterprise projects.