Product

Introducing Webhook Events for Alert Changes

Add real-time Socket webhook events to your workflows to automatically receive software supply chain alert changes in real time.

@cowprotocol/sdk-flash-loans

Advanced tools

Execute flash loan-based collateral swaps using Aave Protocol V3 integrated with CoW Protocol for optimal trading execution.

This SDK facilitates complex flash loan operations where you can:

The order is signed using EIP-1271 with a deterministically generated smart contract address as the signer.

npm install @cowprotocol/sdk-flash-loans

# or

pnpm add @cowprotocol/sdk-flash-loans

# or

yarn add @cowprotocol/sdk-flash-loans

You'll also need the trading SDK:

npm install @cowprotocol/sdk-trading

You need:

chainId - Supported chain ID (see SDK config)appCode - Unique app identifier for tracking orderssigner - Private key, ethers signer, or Eip1193 providerTradingSdk instance - For getting quotes and posting ordersimport { AaveCollateralSwapSdk } from '@cowprotocol/sdk-flash-loans'

import { TradingSdk } from '@cowprotocol/sdk-trading'

import { SupportedChainId } from '@cowprotocol/sdk-config'

import { OrderKind } from '@cowprotocol/sdk-order-book'

import { ViemAdapter } from '@cowprotocol/sdk-viem-adapter'

import { createPublicClient, http, privateKeyToAccount } from 'viem'

import { gnosis } from 'viem/chains'

// Set up adapter

const adapter = new ViemAdapter({

provider: createPublicClient({

chain: gnosis,

transport: http('YOUR_RPC_URL')

}),

signer: privateKeyToAccount('YOUR_PRIVATE_KEY' as `0x${string}`)

})

// Initialize the Trading SDK

const tradingSdk = new TradingSdk(

{

chainId: SupportedChainId.GNOSIS_CHAIN,

appCode: 'aave-v3-flashloan',

},

{},

adapter

)

// Initialize the Flash Loan SDK

const flashLoanSdk = new AaveCollateralSwapSdk()

// Execute collateral swap

const result = await flashLoanSdk.collateralSwap(

{

chainId: SupportedChainId.GNOSIS_CHAIN,

tradeParameters: {

sellToken: '0xe91D153E0b41518A2Ce8Dd3D7944Fa863463a97d', // WXDAI

sellTokenDecimals: 18,

buyToken: '0x2a22f9c3b484c3629090FeED35F17Ff8F88f76F0', // USDC.e

buyTokenDecimals: 6,

amount: '20000000000000000000', // 20 WXDAI

kind: OrderKind.SELL,

validFor: 600, // 10 minutes

slippageBps: 50, // 0.5% slippage

},

collateralToken: '0xd0Dd6cEF72143E22cCED4867eb0d5F2328715533', // aGnoWXDAI (Aave interest-bearing WXDAI)

flashLoanFeePercent: 0.05, // 0.05% flash loan fee

},

tradingSdk

)

console.log('Flash loan order created:', result.orderId)

For maximum control over the process, including manual approval management:

import { AaveCollateralSwapSdk } from '@cowprotocol/sdk-flash-loans'

import { TradingSdk } from '@cowprotocol/sdk-trading'

import { SupportedChainId } from '@cowprotocol/sdk-config'

import { OrderKind } from '@cowprotocol/sdk-order-book'

const flashLoanSdk = new AaveCollateralSwapSdk()

const collateralToken = '0xd0Dd6cEF72143E22cCED4867eb0d5F2328715533' // aGnoWXDAI

// Step 1: Prepare quote parameters

const params = {

chainId: SupportedChainId.GNOSIS_CHAIN,

tradeParameters: {

sellToken: '0xe91D153E0b41518A2Ce8Dd3D7944Fa863463a97d',

sellTokenDecimals: 18,

buyToken: '0x2a22f9c3b484c3629090FeED35F17Ff8F88f76F0',

buyTokenDecimals: 6,

amount: '20000000000000000000',

kind: OrderKind.SELL,

},

collateralToken,

flashLoanFeePercent: 0.05,

}

const quoteParams = await flashLoanSdk.getSwapQuoteParams(params)

// Step 2: Get quote

const quoteAndPost = await tradingSdk.getQuote(quoteParams)

const { quoteResults } = quoteAndPost

// Step 3: Review the quote

const buyAmount = quoteResults.amountsAndCosts.afterSlippage.buyAmount

console.log(`You will receive at least: ${buyAmount} tokens`)

// Step 4: Generate order settings and get instance address

const { swapSettings, instanceAddress } = await flashLoanSdk.getOrderPostingSettings(

params,

quoteParams,

quoteResults

)

// Step 5: Check collateral allowance

const sellAmount = BigInt(params.tradeParameters.amount)

const allowance = await flashLoanSdk.getCollateralAllowance({

trader: quoteParams.owner,

collateralToken,

amount: sellAmount,

instanceAddress,

})

console.log(`Current allowance: ${allowance.toString()}`)

console.log(`Required amount: ${sellAmount.toString()}`)

// Step 6: Approve collateral if needed

if (allowance < sellAmount) {

console.log('Insufficient allowance, approving...')

const txResponse = await flashLoanSdk.approveCollateral({

trader: quoteParams.owner,

collateralToken,

amount: sellAmount,

instanceAddress,

})

console.log('Approval transaction:', txResponse.hash)

// Optionally wait for confirmation here

} else {

console.log('Sufficient allowance already exists')

}

// Step 7: Post the order

const result = await quoteAndPost.postSwapOrderFromQuote(swapSettings)

console.log('Order posted:', result.orderId)

Aave flash loans typically charge a fee (currently 0.05% on most assets). This fee is:

flashLoanFeePercent parameterExample:

// With 0.05% flash loan fee on 20 WXDAI:

// - Flash loan: 20 WXDAI

// - Fee: 0.01 WXDAI (0.05% of 20)

// - Actual swap amount: 19.99 WXDAI

{

amount: '20000000000000000000',

flashLoanFeePercent: 0.05, // 0.05%

}

The collateralToken parameter specifies which Aave interest-bearing token (aToken) will be used as collateral for the flash loan operation.

When you deposit assets into Aave, you receive aTokens (e.g., aWXDAI, aUSDC) that:

const AAVE_TOKENS = {

aGnoWXDAI: '0xd0Dd6cEF72143E22cCED4867eb0d5F2328715533', // Aave WXDAI

aGnoUSDC: '0xc6B7AcA6DE8a6044E0e32d0c841a89244A10D284', // Aave USDC

// Add more as needed

}

const result = await flashLoanSdk.collateralSwap(

{

chainId: SupportedChainId.GNOSIS_CHAIN,

tradeParameters: {

sellToken: '0xe91D153E0b41518A2Ce8Dd3D7944Fa863463a97d', // WXDAI (what we're swapping)

buyToken: '0x2a22f9c3b484c3629090FeED35F17Ff8F88f76F0', // USDC.e (what we want)

amount: '20000000000000000000',

kind: OrderKind.SELL,

},

collateralToken: '0xd0Dd6cEF72143E22cCED4867eb0d5F2328715533', // aGnoWXDAI (our Aave collateral)

flashLoanFeePercent: 0.05,

},

tradingSdk

)

Important Notes:

collateralToken must be an Aave aToken addresssellToken (which is the underlying asset being swapped)Before executing a collateral swap, the flash loan adapter needs approval to spend your collateral tokens. The SDK handles this automatically but also provides methods for manual control.

By default, collateralSwap() automatically checks and approves collateral if needed:

// Automatic approval happens here

const result = await flashLoanSdk.collateralSwap(

{

chainId: SupportedChainId.GNOSIS_CHAIN,

tradeParameters: { /* ... */ },

collateralToken: '0xd0Dd6cEF72143E22cCED4867eb0d5F2328715533', // aGnoWXDAI

},

tradingSdk

)

For more control over the approval process:

// Step 1: Get the adapter instance address

const quoteParams = await flashLoanSdk.getSwapQuoteParams(params)

const quoteAndPost = await tradingSdk.getQuote(quoteParams)

const { swapSettings, instanceAddress } = await flashLoanSdk.getOrderPostingSettings(

params,

quoteParams,

quoteAndPost.quoteResults

)

const sellAmount = BigInt(params.tradeParameters.amount)

// Step 2: Check current allowance

const allowance = await flashLoanSdk.getCollateralAllowance({

trader: quoteParams.owner,

collateralToken: '0xd0Dd6cEF72143E22cCED4867eb0d5F2328715533',

amount: sellAmount,

instanceAddress,

})

console.log('Current allowance:', allowance.toString())

// Step 3: Approve if needed

if (allowance < sellAmount) {

const txResponse = await flashLoanSdk.approveCollateral({

trader: quoteParams.owner,

collateralToken: '0xd0Dd6cEF72143E22cCED4867eb0d5F2328715533',

amount: sellAmount,

instanceAddress,

})

console.log('Approval transaction:', txResponse.hash)

// Wait for confirmation...

}

// Step 4: Execute swap with approval prevention

const result = await flashLoanSdk.collateralSwap(

{

chainId: SupportedChainId.GNOSIS_CHAIN,

tradeParameters: { /* ... */ },

collateralToken: '0xd0Dd6cEF72143E22cCED4867eb0d5F2328715533',

settings: {

preventApproval: true, // Skip automatic approval

},

},

tradingSdk

)

For tokens that support EIP-2612, you can use permit for gasless approval:

// Generate permit signature (implementation varies by wallet)

const collateralPermit = {

amount: 0,

deadline: Math.floor(Date.now() / 1000) + 3600, // 1 hour

v: 27,

r: '0x...',

s: '0x...',

}

const result = await flashLoanSdk.collateralSwap(

{

chainId: SupportedChainId.GNOSIS_CHAIN,

tradeParameters: { /* ... */ },

collateralToken: '0xd0Dd6cEF72143E22cCED4867eb0d5F2328715533',

settings: {

collateralPermit, // Use permit instead of approve

},

},

tradingSdk

)

The SDK uses CoW Protocol hooks to orchestrate the flash loan:

All hooks are automatically configured and gas estimated by the SDK.

Common errors and solutions:

Insufficient flash loan amount

// Error: Flash loan amount doesn't cover fee + swap

// Solution: Increase amount or adjust flash loan fee

{

amount: '20000000000000000000', // Increase this

flashLoanFeePercent: 0.05,

}

Slippage too tight

// Error: Slippage tolerance too low for current market conditions

// Solution: Increase slippageBps

{

slippageBps: 100, // Increase from 50 to 100 (1%)

}

Order expired

// Error: Order validity period too short

// Solution: Increase validFor

{

validFor: 1200, // 20 minutes instead of 10

}

Flash loan orders use EIP-1271 signature verification with a deterministically generated smart contract address. This enables:

The SDK automatically:

Adapter contracts are:

FAQs

Flash loans for CoW Protocol

We found that @cowprotocol/sdk-flash-loans demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 5 open source maintainers collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Product

Add real-time Socket webhook events to your workflows to automatically receive software supply chain alert changes in real time.

Security News

ENISA has become a CVE Program Root, giving the EU a central authority for coordinating vulnerability reporting, disclosure, and cross-border response.

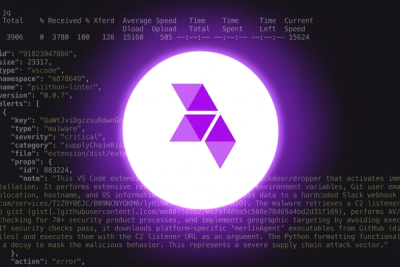

Product

Socket now scans OpenVSX extensions, giving teams early detection of risky behaviors, hidden capabilities, and supply chain threats in developer tools.