Product

Introducing Rust Support in Socket

Socket now supports Rust and Cargo, offering package search for all users and experimental SBOM generation for enterprise projects.

Estimate systematic liquidity in the market using only close and volume data: https://www.financialresearch.gov/working-papers/files/OFRwp-2015-11_Systemwide-Commonalities-in-Market-Liquidity.pdf

pip install systemic_risk

or

pip install -U systemic_risk

import yfinance as yf

from systemic_risk import Liquidity as lq

yf_df = yf.download('SPY, ^FTSE, ^N225', start='2003-01-01', end='2022-01-01')

close, volume = yf_df["Close"].to_numpy(), yf_df["Volume"].to_numpy()

obj = lq.Liquidity(close, volume)

obj.fit_transform()

from systemic_risk import BrownianBridgeSim as bbs

simulated_data = bbs.BrownianBridgeSim(close).simulate()

print(simulated_data.shape)

Flynn Chen Daniel Rodriguez Sony Wicaksono Doris Schioberg Devon Cross William Casey King

This project is licensed under the MIT License - see the LICENSE file for details

FAQs

A package for calculating systemic risk in the market

We found that systemic-risk demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 1 open source maintainer collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Product

Socket now supports Rust and Cargo, offering package search for all users and experimental SBOM generation for enterprise projects.

Product

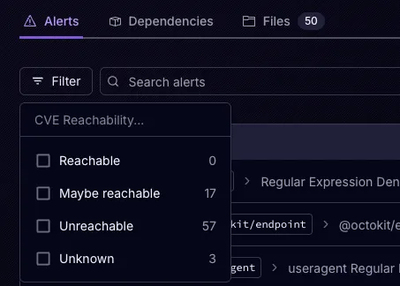

Socket’s precomputed reachability slashes false positives by flagging up to 80% of vulnerabilities as irrelevant, with no setup and instant results.

Product

Socket is launching experimental protection for Chrome extensions, scanning for malware and risky permissions to prevent silent supply chain attacks.