Security News

PyPI’s New Archival Feature Closes a Major Security Gap

PyPI now allows maintainers to archive projects, improving security and helping users make informed decisions about their dependencies.

finmodels is a Python package that provides various financial models for analysis and optimization.

finmodels is a Python package designed for financial analysis and optimization. It includes a collection of financial models, such as Discounted Cash Flow (DCF) valuation and Mean-Variance Portfolio Optimization. With finmodels, you can perform essential financial calculations to support investment decisions and portfolio management.

Discounted Cash Flow (DCF) Valuation: Calculate the present value of future cash flows to assess the intrinsic value of an investment.

Portfolio Optimization: Optimize portfolio allocations using Mean-Variance Optimization to balance returns and risk.

The Leveraged Buyout (LBO) Model: LBO Model is a financial analysis tool used in corporate finance for

evaluating the acquisition of a company using a significant amount of borrowed funds.

IPO Model: IPO Model is a simple Python script for calculating the Initial Public Offering (IPO) valuation using a discounted cash flow (DCF) model.

You can install the package using pip:

pip install finmodels

Usage Discounted Cash Flow (DCF) Valuation

import finmodels as fm

cash_flows = [100, 150, 200, 250]

discount_rate = 0.1

dcf_value = fm.calculate_dcf(cash_flows, discount_rate)

print("DCF Value:", dcf_value)

import finmodels as fm

import numpy as np

# Example usage of portfolio optimization

expected_returns = np.array([0.05, 0.08, 0.12])

covariance_matrix = np.array([[0.001, 0.0005, 0.0002],

[0.0005, 0.002, 0.001],

[0.0002, 0.001, 0.003]])

optimal_weights = fm.optimize_portfolio(expected_returns, covariance_matrix)

print("Optimal Portfolio Weights:", optimal_weights)

import finmodels as fm

# Example usage

acquisition_price_example = 1000

equity_percentage_example = 0.3

debt_interest_rate_example = 0.05

projection_years_example = 5

# Create an instance of LBOModel

lbo_model = fm.LBOModel(acquisition_price_example, equity_percentage_example,

debt_interest_rate_example, projection_years_example)

# Calculate and print equity returns

equity_returns_result = lbo_model.calculate_equity_returns()

print(f"Equity Returns for each year: {equity_returns_result}")

import finmodels as fm

# Example usage

initial_valuation = 500000000 # Initial company valuation before IPO

funds_raised = 100000000 # Funds raised during the IPO

operating_income = 75000000 # Annual operating income before IPO

growth_rate = 0.05 # Annual growth rate of operating income

years = 5 # Number of years for the IPO model

ipo_model = fm.IPOModel(initial_valuation, funds_raised, operating_income, growth_rate, years)

ipo_model.print_summary()

Tamilselvan Arjunan

This project is licensed under the MIT License - see the LICENSE file for details.

FAQs

finmodels is a Python package that provides various financial models for analysis and optimization.

We found that finmodels demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 1 open source maintainer collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Security News

PyPI now allows maintainers to archive projects, improving security and helping users make informed decisions about their dependencies.

Research

Security News

Malicious npm package postcss-optimizer delivers BeaverTail malware, targeting developer systems; similarities to past campaigns suggest a North Korean connection.

Security News

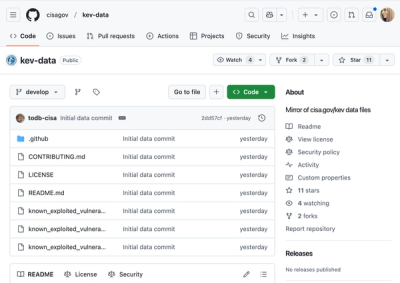

CISA's KEV data is now on GitHub, offering easier access, API integration, commit history tracking, and automated updates for security teams and researchers.