Security News

Research

Data Theft Repackaged: A Case Study in Malicious Wrapper Packages on npm

The Socket Research Team breaks down a malicious wrapper package that uses obfuscation to harvest credentials and exfiltrate sensitive data.

*** IMPORTANT LEGAL DISCLAIMER ***Yahoo!, Y!Finance, and Yahoo! finance are registered trademarks of Yahoo, Inc. yf_as_dataframe is not affiliated, endorsed, or vetted by Yahoo, Inc. It is an open-source tool that uses Yahoo's publicly available APIs, and is intended for research and educational purposes. You should refer to Yahoo!'s terms of use (here, here, and here) for details on your rights to use the actual data downloaded. Remember - the Yahoo! finance API is intended for personal use only. |

This package provides for pulling data from Yahoo!'s unofficial API, and providing that data using using Polars dataframes in ruby. Data in those dataframes can then be easily post-processed using technical indicators provided by Tulip via Tulirb's ruby bindings, and visualized using Vega.

The Ticker class, which allows you to access ticker data from Yahoo!'s unofficial API:

msft = YfAsDataframe::Ticker.new("MSFT")

# get all stock info

msft.info

# get historical market data as a dataframe

hist = msft.history(period: "1mo")

hist2 = msft.history(start: '2020-01-01', fin: '2021-12-31')

# show meta information about the history (requires history() to be called first)

msft.history_metadata

# show actions (dividends, splits, capital gains)

msft.actions

msft.dividends

msft.splits

msft.capital_gains # only for mutual funds & etfs

# show share count

msft.shares_full(start: "2022-01-01", fin: nil)

# show financials:

# - income statement

msft.income_stmt

msft.quarterly_income_stmt

# - balance sheet

msft.balance_sheet

msft.quarterly_balance_sheet

# - cash flow statement

msft.cashflow

msft.quarterly_cashflow

# show holders

msft.major_holders

msft.institutional_holders

msft.mutualfund_holders

msft.insider_transactions

msft.insider_purchases

msft.insider_roster_holders

# show recommendations

msft.recommendations

msft.recommendations_summary

msft.upgrades_downgrades

# Show future and historic earnings dates, returns at most next 4 quarters and last 8 quarters by default.

msft.earnings_dates

# show ISIN code

# ISIN = International Securities Identification Number

msft.isin

# show options expirations

msft.options

# show news

msft.news

# get option chain for specific expiration

opt = msft.option_chain('2026-12-18')

# data available via: opt.calls, opt.puts

# technical operations, using the Tulirb gem, which provides bindings to

# the Tulip technical indicators library

h = msft.history(period: '2y', interval: '1d')

YfAsDataframe.ad(h)

# then

h.insert_at_idx(h.columns.length, YfAsDataframe.ad(h))

h['ad_results'] = YfAsDataframe.ad(h)

Most of the indicators are found here and here. Indicator parameters in Tulirb called, e.g., "period" or "short_period" are renamed as "window" or "short_window", respectively. There are a few other variants that are affected. Default values are shown below.

df = msft.history(period: '3y', interval: '1d') # for example

YfAsDataframe.ad(df)

YfAsDataframe.adosc(df, short_window: 2, long_window: 5)

YfAsDataframe.adx(df, column: 'Adj Close', window: 5)

YfAsDataframe.adxr(df, column: 'Adj Close', window: 5)

YfAsDataframe.avg_daily_trading_volume(df, window: 20)

YfAsDataframe.ao(df)

YfAsDataframe.apo(df, column: 'Adj Close', short_window: 12, long_window: 29)

YfAsDataframe.aroon(df, window: 20)

YfAsDataframe.aroonosc(df, window: 20)

YfAsDataframe.avg_price(df)

YfAsDataframe.atr(df, window: 20)

YfAsDataframe.bbands(df, column: 'Adj Close', window: 20, stddev: 1 )

YfAsDataframe.bop(df)

YfAsDataframe.cci(df, window: 20)

YfAsDataframe.cmo(df, column: 'Adj Close', window: 20)

YfAsDataframe.cvi(df, window: 20)

YfAsDataframe.dema(df, column: 'Adj Close', window: 20)

YfAsDataframe.di(df, window: 20)

YfAsDataframe.dm(df, window: 20)

YfAsDataframe.dpo(df, column: 'Adj Close', window: 20)

YfAsDataframe.dx(df, window: 20)

YfAsDataframe.ema(df, column: 'Adj Close', window: 5)

YfAsDataframe.emv(df)

YfAsDataframe.fisher(df, window: 20)

YfAsDataframe.fosc(df, window: 20)

YfAsDataframe.hma(df, column: 'Adj Close', window: 5)

YfAsDataframe.kama(df, column: 'Adj Close', window: 5)

YfAsDataframe.kvo(df, short_window: 5, long_window: 20)

YfAsDataframe.linreg(df, column: 'Adj Close', window: 20)

YfAsDataframe.linregintercept(df, column: 'Adj Close', window: 20)

YfAsDataframe.linregslope(df, column: 'Adj Close', window: 20)

YfAsDataframe.macd(df, column: 'Adj Close', short_window: 12, long_window: 26, signal_window: 9)

YfAsDataframe.marketfi(df)

YfAsDataframe.mass(df, window: 20)

YfAsDataframe.max(df, column: 'Adj Close', window: 20)

YfAsDataframe.md(df, column: 'Adj Close', window: 20)

YfAsDataframe.median_price(df)

YfAsDataframe.mfi(df, window: 20)

YfAsDataframe.min(df, column: 'Adj Close', window: 20)

YfAsDataframe.mom(df, column: 'Adj Close', window: 5)

YfAsDataframe.moving_avgs(df, window: 20)

YfAsDataframe.natr(df, window: 20)

YfAsDataframe.nvi(df)

YfAsDataframe.obv(df)

YfAsDataframe.ppo(df, column: 'Adj Close', short_window: 12, long_window: 26)

YfAsDataframe.psar(df, acceleration_factor_step: 0.2, acceleration_factor_maximum: 2)

YfAsDataframe.pvi(df)

YfAsDataframe.qstick(df, window: 20)

YfAsDataframe.roc(df, column: 'Adj Close', window: 20)

YfAsDataframe.rocr(df, column: 'Adj Close', window: 20)

YfAsDataframe.rsi(df, window: 20)

YfAsDataframe.sma(df, column: 'Adj Close', window: 20)

YfAsDataframe.stddev(df, column: 'Adj Close', window: 20)

YfAsDataframe.stderr(df, column: 'Adj Close', window: 20)

YfAsDataframe.stochrsi(df, column: 'Adj Close', window: 20)

YfAsDataframe.sum(df, column: 'Adj Close', window: 20)

YfAsDataframe.tema(df, column: 'Adj Close', window: 20)

YfAsDataframe.tr(df, column: 'Adj Close')

YfAsDataframe.trima(df, column: 'Adj Close', window: 20)

YfAsDataframe.trix(df, column: 'Adj Close', window: 20)

YfAsDataframe.trima(df, column: 'Adj Close', window: 20)

YfAsDataframe.tsf(df, column: 'Adj Close', window: 20)

YfAsDataframe.typical_price(df)

YfAsDataframe.ultosc(df, short_window: 5, medium_window: 12, long_window: 26)

YfAsDataframe.weighted_close_price(df)

YfAsDataframe.var(df, column: 'Adj Close', window: 20)

YfAsDataframe.vhf(df, column: 'Adj Close', window: 20)

YfAsDataframe.vidya(df, column: 'Adj Close', short_window: 5, long_window: 20, alpha: 0.2)

YfAsDataframe.volatility(df, column: 'Adj Close', window: 20)

YfAsDataframe.vosc(df, column: 'Adj Close', short_window: 5, long_window: 20)

YfAsDataframe.vol_weighted_moving_avg(df, window: 20)

YfAsDataframe.wad(df)

YfAsDataframe.wcprice(df)

YfAsDataframe.wilders(df, column: 'Adj Close', window: 20)

YfAsDataframe.willr(df, window: 20)

YfAsDataframe.wma(df, column: 'Adj Close', window: 5)

YfAsDataframe.zlema(df, column: 'Adj Close', window: 5)

To graph any of the series using Vega, per the information here, you will need to run

yarn add vega-cli vega-lite

Then, from within irb, you can generate charts, e.g.,

> msft = YfAsDataframe::Ticker.new("MSFT")

# =>

# #<YfAsDataframe::Ticker:0x000000011e6d50a0

# ...

> df = msft.history(period: '3y', interval: '1d')

# =>

# shape: (754, 10)

# ...

> df.insert_at_idx(df.columns.length, YfAsDataframe.ema(df, column: 'Adj Close', window: 5))

# =>

# shape: (753, 11)

# ┌────────────┬────────────┬────────────┬────────────┬───┬───────────┬───────────────┬──────────────┬──────────────────────┐

# │ Timestamps ┆ Open ┆ High ┆ Low ┆ … ┆ Dividends ┆ Capital Gains ┆ Stock Splits ┆ EMA(5) for Adj Close │

# │ --- ┆ --- ┆ --- ┆ --- ┆ ┆ --- ┆ --- ┆ --- ┆ --- │

# │ date ┆ f64 ┆ f64 ┆ f64 ┆ ┆ f64 ┆ f64 ┆ f64 ┆ f64 │

# ╞════════════╪════════════╪════════════╪════════════╪═══╪═══════════╪═══════════════╪══════════════╪══════════════════════╡

# │ 2021-07-12 ┆ 279.160004 ┆ 279.769989 ┆ 276.579987 ┆ … ┆ 0.0 ┆ 0.0 ┆ 0.0 ┆ 270.325745 │

# │ 2021-07-13 ┆ 277.519989 ┆ 282.850006 ┆ 277.390015 ┆ … ┆ 0.0 ┆ 0.0 ┆ 0.0 ┆ 271.514984 │

# │ 2021-07-14 ┆ 282.350006 ┆ 283.660004 ┆ 280.549988 ┆ … ┆ 0.0 ┆ 0.0 ┆ 0.0 ┆ 272.804932 │

# │ 2021-07-15 ┆ 282.0 ┆ 282.51001 ┆ 279.829987 ┆ … ┆ 0.0 ┆ 0.0 ┆ 0.0 ┆ 273.184001 │

# │ 2021-07-16 ┆ 282.070007 ┆ 284.100006 ┆ 279.459991 ┆ … ┆ 0.0 ┆ 0.0 ┆ 0.0 ┆ 273.345751 │

# │ … ┆ … ┆ … ┆ … ┆ … ┆ … ┆ … ┆ … ┆ … │

# │ 2024-07-02 ┆ 453.200012 ┆ 459.589996 ┆ 453.109985 ┆ … ┆ 0.0 ┆ 0.0 ┆ 0.0 ┆ 454.288375 │

# │ 2024-07-03 ┆ 458.190002 ┆ 461.019989 ┆ 457.880005 ┆ … ┆ 0.0 ┆ 0.0 ┆ 0.0 ┆ 456.448913 │

# │ 2024-07-05 ┆ 459.609985 ┆ 468.350006 ┆ 458.970001 ┆ … ┆ 0.0 ┆ 0.0 ┆ 0.0 ┆ 460.152608 │

# │ 2024-07-08 ┆ 466.549988 ┆ 467.700012 ┆ 464.459991 ┆ … ┆ 0.0 ┆ 0.0 ┆ 0.0 ┆ 462.181735 │

# │ 2024-07-09 ┆ 467.0 ┆ 467.329987 ┆ 458.0 ┆ … ┆ 0.0 ┆ 0.0 ┆ 0.0 ┆ 461.30116 │

# └────────────┴────────────┴────────────┴────────────┴───┴───────────┴───────────────┴──────────────┴──────────────────────┘

> File.binwrite('/tmp/chart.png',df.plot("Timestamps", "EMA(5) for Adj Close", type: "line", width:800, height:500).to_png)

# => 44913

Then the following image should be saved at the specified location.

PNG, SVG, and PDF output formats are supported directly. See this page for more information in constructing supported charts.

While it has not been tested yet, images should be able to be produced interactively using iruby operating in a Jupyter environment.

Add this line to your application's Gemfile:

gem 'yf_as_dataframe'

And then execute:

$ bundle install

Or install it yourself as:

$ gem install yf_as_dataframe

To install this gem onto your local machine, run bundle exec rake install. To release a new version, update the version number in version.rb, and then run bundle exec rake release, which will create a git tag for the version, push git commits and the created tag, and push the .gem file to rubygems.org.

Bug reports and pull requests are welcome on GitHub at https://github.com/bmck/yf_as_dataframe.

The yf_as_dataframe gem is available as open source under the MIT Software License (https://opensource.org/licenses/MIT). See the LICENSE.txt file in the release for details.

AGAIN - yf_as_dataframe is not affiliated, endorsed, or vetted by Yahoo, Inc. It's an open-source tool that uses Yahoo's publicly available APIs, and is intended for research and educational purposes. You should refer to Yahoo!'s terms of use (here, here, and here) for details on your rights to use the actual data downloaded.

FAQs

Unknown package

We found that yf_as_dataframe demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 1 open source maintainer collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Security News

Research

The Socket Research Team breaks down a malicious wrapper package that uses obfuscation to harvest credentials and exfiltrate sensitive data.

Research

Security News

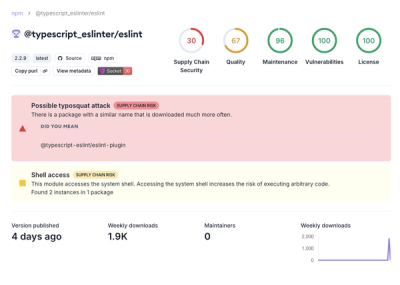

Attackers used a malicious npm package typosquatting a popular ESLint plugin to steal sensitive data, execute commands, and exploit developer systems.

Security News

The Ultralytics' PyPI Package was compromised four times in one weekend through GitHub Actions cache poisoning and failure to rotate previously compromised API tokens.