Security News

Research

Data Theft Repackaged: A Case Study in Malicious Wrapper Packages on npm

The Socket Research Team breaks down a malicious wrapper package that uses obfuscation to harvest credentials and exfiltrate sensitive data.

Pandas and SciKit Learn compatible open source interface for algorithmic trading functions.

infertrade is an open source trading and investment strategy library designed for accessibility and compatibility.

The infertrade package seeks to achieve three objectives:

Simplicity: a simple pandas to pandas interface that those experienced in trading but new to Python can easily use.

Gateway to data science: classes that allow rules created for the infertrade simple interface to be used with scikit-learn functionality for prediction and calibration. (fit, transform, predict, pipelines, gridsearch) and scikit-learn compatible libraries, like feature-engine.

The best open source trading strategies: wrapping functionality to allow strategies from any open source Python libraries with compatible licences, such as ta to be used with the infertrade interface.

The project is licenced under the Apache 2.0 licence.

Many thanks for looking into the infertrade package!

I created InferTrade.com to provide cutting edge statistical analysis in an accessible free interface. The intention was to help individuals and small firms have access to the same quality of analysis as large institutions for systematic trading and to allow more time to be spent on creating good signals rather than backtesting and strategy verification. If someone has done the hard work of gaining insights into markets I wanted them to be able to compete in a landscape of increasingly automated statistically-driven market participants. A huge amount of effort has been made by the trading and AI/ML communities to create open source packages with powerful diagnostic functionality, which means you do not need to build a large and complex in-house analytics library to be able to support your investment decisions with solid statistical machine learning. However there remain educational and technical barriers to using this community-created wealth if you are not an experience programmer or do not have mathematical training. I want InferTrade.com to allow everyone trading in markets to have access without barriers - cost, training or time - to be competitive, with an easy to use interface that both provides direct analysis and education insights to support your trading.

The initial impetus for the creation of this open source package, infertrade was to ensure any of our users finding an attractive strategy on InferTrade.com could easily implement the rule in Python and have full access to the code to fully understand every aspect of how it works. By adding wrapper for existing libraries we hope to support further independent backtesting by users with their own preferred choice of trading libraries. We at InferStat heavily use open source in delivering InferTrade.com's functionality and we also wanted to give something back to the trading and data science community. The Apache 2.0 licence is a permissive licence, so that you can use or build upon infertrade for your personal, community or commercial projects.

The infertrade package and InferTrade.com will be adding functionality each week, and we are continually seeking to improve the experience and support the package and website provides for traders, portfolio managers and other users. Gaining feedback on new features is extremely helpful for us to improve our UX and design, as are any ideas for enhancements that would help you to trade better. If you would like to assist me in turning InferTrade into the leading open source trading platform we can offer participation in our Beta Testing programme (sign up link). You can also fork this repository and make direct improvements to the package.

Best, Tom Oliver

InferStat Founder and CEO

This was InferStat's first open source project and we welcome your thoughts for improvements to code structure, documentation or any changes that would support your use of the library.

If you would like assistance with using the infertrade you can email us at support@infertrade.com or book a video call

If you would like to contribute to the package, e.g. to add support for an additional package or library, please see our contributing information.

If you want guidance on infertrade API then please see our API Guidance information.

Please note the project requires Python 3.7 or higher due to dependent libraries used.

See Windows or Linux guides for installation details.

import pandas as pd

import matplotlib.pyplot as plt

def my_first_infertrade_rule(df: pd.DataFrame) -> pd.DataFrame:

df["allocation"] = 0.0

df["allocation"][df.pct_change() > 0.02] = 0.5

return df

my_dataframe = pd.read_csv("example_market_data.csv")

my_dataframe_with_allocations = my_first_infertrade_rule(my_dataframe)

my_dataframe_with_allocations.plot(["close"], ["allocation"])

plt.show()

"Community" functions are those declared in this repository, not retrieved from an external package. They are all exposed at infertrade.algos.community.

from infertrade.algos.community import normalised_close, scikit_signal_factory

from infertrade.data.simulate_data import simulated_market_data_4_years_gen

signal_transformer = scikit_signal_factory(normalised_close)

signal_transformer.fit_transform(simulated_market_data_4_years_gen())

from infertrade.algos.community import scikit_signal_factory

from infertrade.data.simulate_data import simulated_market_data_4_years_gen

from infertrade.algos import ta_adaptor

from ta.trend import AroonIndicator

adapted_aroon = ta_adaptor(AroonIndicator, "aroon_down", window=1)

signal_transformer = scikit_signal_factory(adapted_aroon)

signal_transformer.fit_transform(simulated_market_data_4_years_gen())

from infertrade.algos.community.allocations import constant_allocation_size

from infertrade.utilities.operations import scikit_allocation_factory

from infertrade.data.simulate_data import simulated_market_data_4_years_gen

position_transformer = scikit_allocation_factory(constant_allocation_size)

position_transformer.fit_transform(simulated_market_data_4_years_gen())

from infertrade.algos.community import scikit_signal_factory

from infertrade.data.simulate_data import simulated_market_data_4_years_gen

from infertrade.utilities.operations import PositionsFromPricePrediction, PricePredictionFromSignalRegression

from sklearn.pipeline import make_pipeline

from infertrade.algos import ta_adaptor

from ta.trend import AroonIndicator

adapted_aroon = ta_adaptor(AroonIndicator, "aroon_down", window=1)

pipeline = make_pipeline(scikit_signal_factory(adapted_aroon),

PricePredictionFromSignalRegression(),

PositionsFromPricePrediction()

)

pipeline.fit_transform(simulated_market_data_4_years_gen())

For convenience, the infertrade.data module contains some basic functions for simulating market data.

import matplotlib.pyplot as plt

from infertrade.data.simulate_data import simulated_market_data_4_years_gen

simulated_market_data_4_years_gen().plot(y=["open", "close", "high", "low", "last"])

plt.show()

import matplotlib.pyplot as plt

from infertrade.data.simulate_data import simulated_correlated_equities_4_years_gen

simulated_correlated_equities_4_years_gen().plot(y=["price", "signal"])

plt.show()

The "infertrade.api" module contains an Api class with multiple useful functions including "export_to_csv" which is used to export portfolio performance as a CSV file.

The function accepts up to two dataframes containing market data, a rule name and a relationship name and the output would be a CSV file containing information about the provided rule and relationship perfomance with provided market data.

from infertrade.api import Api

Api.export_to_csv(dataframe="MarketData", rule_name="weighted_moving_averages")

"""Resulting CSV file would contain portfolio performance of supplied MarketData

after trading using weighted moving averages"""

Api.export_to_csv(dataframe="MarketData1", second_df="MarketData2", rule_name="weighted_moving_averages", relationship="change_relationship")

"""Resulting CSV file would contain portfolio performance of supplied MarketData1 and MarketData2

after trading using weighted moving averages and calculating the change relationship"""

Besides the "infertrade.api.export_to_csv" method out api module contains "infertrade.api.export_cross_prediction"

The function accepts a list of dataframes containing market data and sequentially calculates the performance of trading strategy using pairwise combination

from infertrade.api import Api

Api.export_cross_prediction(listOfDataframes)

""" The result of this would be CSV files of every possible combination of supplied data

with relationship calculations of every relationship ranked using the "percent_gain" column """

Api.export_cross_prediction(listOfDataframes,

column_to_sort="percent_gain",

export_as_csv=False)

""" If export_as_csv is set to false the return will only be ranked indexes of dataframes

along with total sum of supplied column used to sort """

Api.export_cross_prediction(listOfDataframes,

number_of_results=3,)

""" number_of_results is used to only save/return top X ranked combinations """

### Using the InferTrade API

The "api_automation" module contains the "execute_it_api_request" function,

by supplying the function with a request name from the API_GUIDANCE.md file

and your API key it is able to execute any call mentioned in the guidance.

```python

from infertrade.utilities.api_automation import execute_it_api_request

execute_it_api_request( request_name="Get trading rule metadata",

api_key="YourApiKey")

Calls that contain data inside of lists ("[]") need you to provide the specified data.In this example, the API request ("Get available time series simulation models") contains two lists and those are : "research_1" and "price" To supply this data we simply pass the lists inside a dictionary as "additional_data"

from infertrade.utilities.api_automation import execute_it_api_request

additional_data = {"price":[0,1,2,3,4,5,6,7,8,9],"research_1":[0,1,2,3,4,5,6,7,8,9]}

execute_it_api_request( request_name="Get available time series simulation models",

api_key="YourApiKey",

additional_data = additional_data)

The passed data does not have to replace data inside a list, you can replace any key listed in the JSON body of the request by using the same feature as before.

If you wish to use your own body or header you can do that by passing them to the function:

from infertrade.utilities.api_automation import execute_it_api_request

execute_it_api_request( request_name="Get available time series simulation models",

api_key="YourApiKey",

request_body = "YourRequestBody",

header = "YourHeader")

The default headers are set to:

headers = {

'Content-Type': 'application/json',

'x-api-key': 'YourApiKey'

}

You can also pass a specific Content Type to the function:

from infertrade.utilities.api_automation import execute_it_api_request

execute_it_api_request( request_name="Get trading rule metadata",

api_key="YourApiKey",

Content_Type="YourContentType")

The default request are executed using the "request" module but if you prefer using the "http.client" you can use the "selected_module" argument inside the function call

from infertrade.utilities.api_automation import execute_it_api_request

execute_it_api_request( request_name="Get trading rule metadata",

api_key="YourApiKey",

selected_module="http.client")

You can also use the "parse_to_csv" function to read data from a csv file either located on your computer or the InferTrade package:

from infertrade.utilities.api_automation import execute_it_api_request, parse_csv_file

data = parse_csv_file(file_name="File_Name")

additional = {"trailing_stop_loss_maximum_daily_loss": "value",

"price": data["Column_Name"],

"research_1": data["Column_Name"]}

response = execute_it_api_request(

request_name="Get available time series simulation models",

api_key="YourApiKey",

additional_data=additional,

)

print(response.txt)

If you are only providing the file name, the function presumes that it is located in "/infertrade/".

The same functions can be used alongside postman to generate request bodies, if you set "execute_request" to false in the function parameters it will return the request body with additional data:

from infertrade.utilities.api_automation import execute_it_api_request, parse_csv_file

data = parse_csv_file(file_location="File_Location")

additional = {"trailing_stop_loss_maximum_daily_loss": "value",

"price": data["Column_Name"],

"research_1": data["Column_Name"]}

response = execute_it_api_request(

request_name="Get available time series simulation models",

api_key="YourApiKey",

additional_data=additional,

execute_request=False

)

print(response)

The result of this will be the request body with "price", "research_1" and "trailing_stop_loss_maximum_daily_loss" set to provided data.

FAQs

Pandas and SciKit Learn compatible open source interface for algorithmic trading functions.

We found that infertrade demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 1 open source maintainer collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Security News

Research

The Socket Research Team breaks down a malicious wrapper package that uses obfuscation to harvest credentials and exfiltrate sensitive data.

Research

Security News

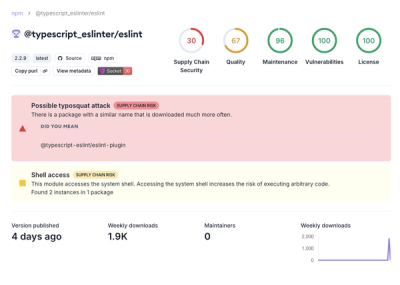

Attackers used a malicious npm package typosquatting a popular ESLint plugin to steal sensitive data, execute commands, and exploit developer systems.

Security News

The Ultralytics' PyPI Package was compromised four times in one weekend through GitHub Actions cache poisoning and failure to rotate previously compromised API tokens.