Research

Security News

Malicious npm Package Targets Solana Developers and Hijacks Funds

A malicious npm package targets Solana developers, rerouting funds in 2% of transactions to a hardcoded address.

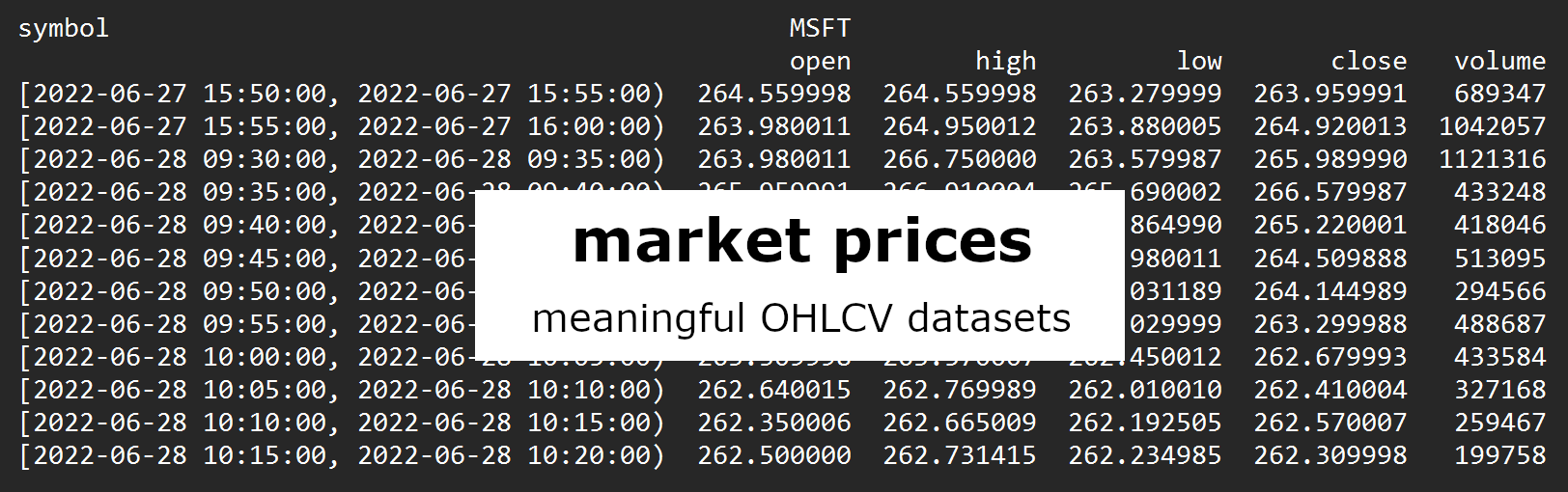

A python library to create meaningful OHLCV datasets for financial instruments.

market_prices provides for enhanced querying and post-processing of financial price data.

Works out-the-box with prices from the Yahoo Finance API via yahooquery (see Disclaimers) or from locally stored .csv files.

$ pip install market-prices

>>> from market_prices import PricesYahoo

>>> prices = PricesYahoo("MSFT") # prices for a single instrument, Microsoft

>>> # OR if Yahoo API endpoints are not all currently available in your region...

>>> prices = PricesYahoo("MSFT", calendars="XNYS", delays=0)

>>> prices.get("5min", minutes=40) # last 40 minutes of prices at 5 minute intervals

symbol MSFT

open high low close volume

[2022-06-27 15:45:00, 2022-06-27 15:50:00) 264.774994 265.108612 264.320007 264.600006 340111.0

[2022-06-27 15:50:00, 2022-06-27 15:55:00) 264.559998 264.559998 263.279999 263.959991 689347.0

[2022-06-27 15:55:00, 2022-06-27 16:00:00) 263.980011 264.950012 263.880005 264.920013 1042057.0

[2022-06-28 09:30:00, 2022-06-28 09:35:00) 263.980011 266.750000 263.579987 265.989990 1121316.0

[2022-06-28 09:35:00, 2022-06-28 09:40:00) 265.959991 266.910004 265.700012 266.579987 353441.0

[2022-06-28 09:40:00, 2022-06-28 09:45:00) 266.589996 266.869995 264.880005 265.220001 418320.0

[2022-06-28 09:45:00, 2022-06-28 09:50:00) 265.225006 265.350006 263.980011 264.509888 512821.0

[2022-06-28 09:50:00, 2022-06-28 09:55:00) 264.509888 264.509888 264.509888 264.509888 0.0

The above call was made 21 minutes after the NYSE open. Notice that the call returns the last 40 trading minutes of data, NOT the arbitrary number of trading minutes that may have fallen within the last 40 minutes according to the clock on the wall.

Any interval can be evaluated (limited only by the availability of underlying data).

>>> # prices over a specific session at 68 minute intervals

>>> prices.get("68min", start="2022-06-27", end="2022-06-27", force=True)

symbol MSFT

open high low close volume

[2022-06-27 09:30:00, 2022-06-27 10:38:00) 267.929993 267.929993 264.829987 266.049988 4988476.0

[2022-06-27 10:38:00, 2022-06-27 11:46:00) 266.070007 267.190002 265.130005 266.144989 2516274.0

[2022-06-27 11:46:00, 2022-06-27 12:54:00) 266.160004 266.230011 264.640015 265.614990 2207186.0

[2022-06-27 12:54:00, 2022-06-27 14:02:00) 265.600006 265.714996 264.329987 264.559998 1777625.0

[2022-06-27 14:02:00, 2022-06-27 15:10:00) 264.570007 265.451599 263.855011 264.269989 1849430.0

[2022-06-27 15:10:00, 2022-06-27 16:00:00) 264.260010 265.108612 263.279999 264.920013 3504532.0

NB Here the force option forced the right side of the last indice back to the session close.

For daily data...

>>> prices.get("1D", start="2022-02-15", months=3)

symbol MSFT

open high low close volume

2022-02-15 300.010010 300.799988 297.019989 300.470001 27058300

2022-02-16 298.369995 300.869995 293.679993 299.500000 29982100

2022-02-17 296.359985 296.799988 290.000000 290.730011 32461600

2022-02-18 293.049988 293.859985 286.309998 287.929993 34264000

2022-02-22 285.000000 291.540009 284.500000 287.720001 41736100

... ... ... ... ... ...

2022-05-09 270.059998 272.359985 263.320007 264.579987 47726000

2022-05-10 271.690002 273.750000 265.070007 269.500000 39336400

2022-05-11 265.679993 271.359985 259.299988 260.549988 48975900

2022-05-12 257.690002 259.880005 250.020004 255.350006 51033800

2022-05-13 257.350006 263.040009 255.350006 261.119995 34925100

[62 rows x 5 columns]

Above the period has been defined in calendar months ('years' and 'weeks' are also valid arguments).

Daily data can be easily resampled to a higher interval.

>>> prices.get("3D", days=12) # 12 trading days of data at intervals of 3 sessions

symbol MSFT

open high low close volume

[2022-06-10, 2022-06-15) 260.579987 260.579987 241.509995 244.490005 106210100.0

[2022-06-15, 2022-06-21) 248.309998 255.300003 243.020004 247.649994 109081300.0

[2022-06-21, 2022-06-24) 250.259995 259.369995 249.509995 258.859985 81729600.0

[2022-06-24, 2022-06-29) 261.809998 268.299988 261.720001 264.369995 61089133.0

Although some indices are longer than three calendar days, they all comprise of three trading days (sessions) of data (all indices are closed on the 'right', such that data includes the session that represents the left side of the interval but NOT any session that might be represented by the right side.). Also, the period the dataset covers is 12 sessions, NOT the arbitrary number of sessions that fell within the last 12 days according to the calendar hanging on the wall.

market_prices comes into its own with the creation of datasets comprising instruments that trade on different exchanges.

>>> # Get a prices instance for Microsoft in New York, Alibaba in Hong Kong and 24/7 Bitcoin

>>> prices_mult = PricesYahoo("MSFT, 9988.HK, BTC-USD")

>>> # OR if Yahoo API endpoints are not all currently available in your region...

>>> prices_mult = PricesYahoo(

"MSFT, 9988.HK, BTC-USD", calendars=["XNYS", "XHKG", "24/7"], delays=[0, 15, 0]

)

>>> # lead_symbol determines the exchange against which the period will be evaluated and

>>> # the default output time zone (which for Bitcoin is UTC).

>>> prices_mult.get("90min", hours=9, lead_symbol="BTC-USD")

symbol MSFT 9988.HK BTC-USD

open high low close volume open high low close volume open high low close volume

[2022-06-28 06:00:00, 2022-06-28 07:30:00) NaN NaN NaN NaN NaN 115.400002 119.099998 115.199997 118.000000 16137193.0 20751.832031 20908.732422 20751.832031 20894.144531 643196928.0

[2022-06-28 07:30:00, 2022-06-28 09:00:00) NaN NaN NaN NaN NaN 118.000000 119.699997 117.099998 118.199997 6600305.0 20885.277344 21070.208984 20846.593750 21070.208984 616460288.0

[2022-06-28 09:00:00, 2022-06-28 10:30:00) NaN NaN NaN NaN NaN NaN NaN NaN NaN NaN 21087.283203 21162.541016 21030.169922 21054.451172 376852480.0

[2022-06-28 10:30:00, 2022-06-28 12:00:00) NaN NaN NaN NaN NaN NaN NaN NaN NaN NaN 21047.083984 21069.363281 20958.353516 20995.970703 249643008.0

[2022-06-28 12:00:00, 2022-06-28 13:30:00) NaN NaN NaN NaN NaN NaN NaN NaN NaN NaN 20996.517578 21089.582031 20913.453125 20993.925781 319698944.0

[2022-06-28 13:30:00, 2022-06-28 15:00:00) 263.980011 266.910004 263.210205 263.529999 3027945.0 NaN NaN NaN NaN NaN 20990.644531 21084.759766 20990.644531 21084.759766 88373248.0

By default prices are shown as missing when the exchange is closed (the time zone of the above output is UTC). Indices that would cover periods during which no symbol trades are excluded. (Scroll right on the output to see all the returned data.)

Within any session missing prices between the open and the close are always filled with contiguous data. This happens even for illiquid instruments where the price data alone may give no indication of a session's open or close. (See the exchange_calendars section for how market_prices 'knows' the trading times of each symbol.)

The get method has plenty of options to customize the output, including fill to fill in indices when an exchange is closed...

>>> # as before, only now filling in prices when exchanges are closed

>>> prices_mult.get("90min", hours=9, lead_symbol="BTC-USD", fill="both")

symbol MSFT 9988.HK BTC-USD

open high low close volume open high low close volume open high low close volume

[2022-06-28 06:00:00, 2022-06-28 07:30:00) 263.980011 263.980011 263.980011 263.980011 0.0 115.400002 119.099998 115.199997 118.000000 16137193.0 20751.832031 20908.732422 20751.832031 20894.144531 643196928.0

[2022-06-28 07:30:00, 2022-06-28 09:00:00) 263.980011 263.980011 263.980011 263.980011 0.0 118.000000 119.699997 117.099998 118.199997 6600305.0 20885.277344 21070.208984 20846.593750 21070.208984 616460288.0

[2022-06-28 09:00:00, 2022-06-28 10:30:00) 263.980011 263.980011 263.980011 263.980011 0.0 118.199997 118.199997 118.199997 118.199997 0.0 21087.283203 21162.541016 21030.169922 21054.451172 376852480.0

[2022-06-28 10:30:00, 2022-06-28 12:00:00) 263.980011 263.980011 263.980011 263.980011 0.0 118.199997 118.199997 118.199997 118.199997 0.0 21047.083984 21069.363281 20958.353516 20995.970703 249643008.0

[2022-06-28 12:00:00, 2022-06-28 13:30:00) 263.980011 263.980011 263.980011 263.980011 0.0 118.199997 118.199997 118.199997 118.199997 0.0 20996.517578 21089.582031 20913.453125 20993.925781 319698944.0

[2022-06-28 13:30:00, 2022-06-28 15:00:00) 263.980011 266.910004 263.049988 263.148987 3063273.0 118.199997 118.199997 118.199997 118.199997 0.0 20990.644531 21084.759766 20990.644531 21084.759766 88373248.0

The 'workback' anchor option offers an alternative to anchoring indices on each session's open. The following call requests two trading days of data to a specific minute, at 3 hour intervals, with data evaluated by working back from the last indice.

>>> df = prices.get("3h", end="2022-06-27 15:44", days=2, anchor="workback")

>>> df

symbol MSFT

open high low close volume

[2022-06-24 10:14:00, 2022-06-24 13:14:00) 265.750000 266.459991 263.410004 264.399994 6864301.0

[2022-06-24 13:14:00, 2022-06-27 09:44:00) 264.390015 267.980011 263.640015 265.160004 10765130.0

[2022-06-27 09:44:00, 2022-06-27 12:44:00) 265.149994 267.190002 264.640015 265.100006 7239582.0

[2022-06-27 12:44:00, 2022-06-27 15:44:00) 265.109985 265.714996 263.760010 264.570007 5237309.0

The second indice can be seen to cross sessions. It partly covers the end of a Friday session and partly the start of the subsequent Monday session...

>>> df.index.length

TimedeltaIndex(['0 days 03:00:00', '2 days 20:30:00', '0 days 03:00:00',

'0 days 03:00:00'],

dtype='timedelta64[ns]', freq=None)

Although that indice still comprises only the requested interval of 3 trading hours...

>>> calendar = prices.calendar_default

>>> df.pt.indices_trading_minutes(calendar)

[2022-06-24 10:14:00, 2022-06-24 13:14:00) 180

[2022-06-24 13:14:00, 2022-06-27 09:44:00) 180

[2022-06-27 09:44:00, 2022-06-27 12:44:00) 180

[2022-06-27 12:44:00, 2022-06-27 15:44:00) 180

Name: trading_mins, dtype: int64

The indices_trading_minutes method called above is available via the .pt accessor. (market_prices uses the .pt accessor to make available a host of properties and methods to directly interrogate the price data.)

Whereas the above examples used the get method to create a dataset, the following methods provide for more specific queries.

close_at returns the most recent close price as of a specific date.

>>> prices_mult.close_at("2022-06-27")

symbol MSFT 9988.HK BTC-USD

2022-06-27 264.890015 118.099998 20735.478516

price_at returns prices as at a specific minute.

>>> prices_mult.price_at("2022-06-27 16:22", tz="MSFT")

symbol MSFT 9988.HK BTC-USD

2022-06-27 16:22:00-04:00 264.920013 118.099998 20922.904297

price_range returns OHLCV data over a period defined with the same arguments as get.

>>> # ohlcv data for period comprising 3 sessions to a specific time

>>> prices_mult.price_range(end="2022-06-07 15:22", days=3, lead_symbol="MSFT", stack=True)

open high low close volume

symbol

(2022-06-02 15:22:00, 2022-06-07 15:22:00] 9988.HK 92.800003 101.800003 91.250000 98.800003 1.818390e+08

BTC-USD 30084.296875 31693.291016 29311.683594 30366.656250 6.989303e+10

MSFT 273.535004 274.649994 266.029999 272.149994 5.853911e+07

The quickstart.ipynb tutorial offers a fuller introduction. Here you'll find links to all the tutorials which collectively cover all that market_prices offers.

PricesYahoo to get live and historic prices from the Yahoo Finance API via yahooquery (see Disclaimers).PricesCsv to get price data from locally stored .csv files.pd.DataFrame.pt accessor to interrogate and operate directly on price tables.IntervalIndex that defines both sides of the time interval covered by each row.market_prices comes with a host of notebook tutorials that show example usage and explain every aspect of what's on offer. Check out quickstart.ipynb for a taster.

All tutorials and other documentation are indexed here.

Each method's own documentation is also pretty comprehensive.

The market_analy library uses prices data from market_prices to undertake analyses and create interactive bqplot charts. The demo video covers usage of both libraries.

market_prices is nothing without exchange_calendars.

exchange_calendars provides market_prices:

This knowledge and functionality allows market_prices to:

The functionality offered by market_prices is not reliant on any particular data source, but it does need one!

The default prices class, PricesYahoo, employs the yahooquery library to fetch raw price data. A different data source can be used by simply concreting a subclass of the Abstract Base Class PricesBase (see the developer docs).

:information_source: yahooquery offers broad pythonic access to the Yahoo API - check it out if you're after other financial data!

If you come across missing prices or sessions then the first port of call is to check that the associated calendar is accurate - it may need updating.

errors.PricesMissingWarning will have been raised when the prices were requested.All calendars are maintained by user-contributions. If you find one that needs updating, PR the required changes over at exchange_calendars and it'll filter into market_prices on the next exchange_calendars release. Links to the workflow to update calendars can be found here.

The prices tutorial covers how market_prices associates calendars with symbols.

The first beta version of market_prices was released May 2022.

Whilst the test suite is pretty comprehensive, there will inevitably be bugs. Please do raise an issue with any that you come across. Even better, offer a PR! Contributions welcome.

Please use discussions to make any suggestions and offer general feedback.

market_prices should not be assumed sufficiently reliable to undertake market analysis intended to inform investment decisions. Users should inspect the source code and the test suite of the library and its dependencies in order to make their own assessment of the packages' suitability for their purposes. market_prices is used entirely at the user's own risk.

The default PricesYahoo class requests data from publically available Yahoo APIs via the yahooquery package.

market_prices is NOT in any way affiliated, partnered, sponsored or endorsed by Yahoo. Users of the PricesYahoo class should make enquiries to satisfy themselves that they are eligible to receive data from Yahoo APIs and are in compliance with the license requirements and Terms of Service under which the Yahoo APIs may be accessed, to include restrictions concerning NO COMMERCIAL USE.

Users may find the following references useful in this respect. (These references should not be considered to definitively cover all terms and conditions related to the use of Yahoo APIs.)

Further, it should NOT be assumed that price data returned by the PricesYahoo class will accurately reflect data as provided by Yahoo APIs. In this respect users should make their own inspection of the source code and test suites of market_prices and its dependencies.

FAQs

Meaningful OHLCV datasets

We found that market-prices demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 1 open source maintainer collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Research

Security News

A malicious npm package targets Solana developers, rerouting funds in 2% of transactions to a hardcoded address.

Security News

Research

Socket researchers have discovered malicious npm packages targeting crypto developers, stealing credentials and wallet data using spyware delivered through typosquats of popular cryptographic libraries.

Security News

Socket's package search now displays weekly downloads for npm packages, helping developers quickly assess popularity and make more informed decisions.