Security News

Research

Data Theft Repackaged: A Case Study in Malicious Wrapper Packages on npm

The Socket Research Team breaks down a malicious wrapper package that uses obfuscation to harvest credentials and exfiltrate sensitive data.

py-portfolio-index is a python library to make it easier to mantain a broad, index-based approach to stock investing while being able to layer in personal preferences, such as to exclude or reweight certain kinds of stocks.

For example, a user could construct a portfolio that matches the composition of the S&P 500, but excludes oil companies and overweights semiconductor companies.

To do that, it provides tools for constructing and managing portfolios that are modeled off indexes. These ideal portfolios can be efficiently converted into actual portfolios by API, using commission free platforms like Robinhood, Alpaca, or Webull. Since constructing an index analogue typically requires many small stock purchases, a commission free platform is important to minimizing overhead. For small investment sizes, the ability of the platform to support fractional shares is critical to being able to accurately map to the index.

py-portfolio-index contains a default set of indexes, which can be access via the INDEXES dictionary: from py_portfolio_index import INDEXES. These indexes are based on the common industry index cuts such as

Large Cap or real-estate and are updated quarterly.

py-portfolio-index also contains a default list of stock lists, which can be access via the STOCK_LISTS dictionary: from py_portfolio_index import STOCK_LISTS. These lists are thematic groupings, such as by industry (oil, space)

or by other criteria (vice). Lists can be applied to modify indexes or reweight them to create customized

portfolios.

The package supports Python 3.9+.

pip install py-portfolio-index

Note that provider dependencies must be installed independently for each provider you wish to use.

pip install alpaca-trade-api or pip install py-portfolio-index[alpaca]pip install robin_stocks or pip install py-portfolio-index[robinhood]pip install webull or pip install py-portfolio-index[webull]pip install schwab-py or pip install py-portfolio-index[schwab]Default index construction uses market orders and assumes an accumulative portfolio.

Some market information may be internally cached for up to an hour to improve performnace. py-portfolio-index is not designed for active day-trading.

Some providers may take some time to place an order. Keep this in mind when running repeated rebalances, as the portfolio balance may not have updated to reflect your last order.

Remember that the stock markets are not always open! Providers may vary in their treatment of market hours.

This example shows a basic example using the Alpaca API in paper trading mode.

It constructs an ideal portfolio based on the composition of the Vanguard ESG index fund in Q4 2020, then uses the Alpaca API to construct a matching portfolio based on an initial investment of 10000 dollars.

from py_portfolio_index import INDEXES, STOCK_LISTS, Logger, AlpacaProvider, PurchaseStrategy, generate_order_plan

from logging import INFO, StreamHandler

Logger.addHandler(StreamHandler())

Logger.setLevel(INFO)

# The size of our paper portfolio

TARGET_PORTFOLIO_SIZE = 10000

# instantiate the Alpaca provider with identity information

# and set it to use the paper provider

# this expects the environment variables ALPACA_API_KEY and ALPACA_API_SECRET to be set,

# or they can be passed in directly, using AlpacaProvider(key_id=..., secret_key=...)

provider = AlpacaProvider()

# get an example index

ideal_portfolio = INDEXES['small_cap']

# exclude all stocks from the oil, vice, and cruise lists

ideal_portfolio.exclude(STOCK_LISTS['oil']).exclude(STOCK_LISTS['vice']).exclude(STOCK_LISTS['cruises'])

# double the weighting of stocks in the renewable and semiconductor lists, and set them to a minimum weight of .1%

ideal_portfolio.reweight(STOCK_LISTS['renewable'], weight=2.0, min_weight=.001)

ideal_portfolio.reweight(STOCK_LISTS['semiconductor'], weight=2.0, min_weight=.001)

# get actual holdings

real_port = provider.get_holdings()

# compare actual holdings to this ideal portfolio to produce a buy and sell list

planned_orders = generate_order_plan(ideal=ideal_portfolio, real=real_port,

buy_order=PurchaseStrategy.LARGEST_DIFF_FIRST,

target_size=TARGET_PORTFOLIO_SIZE)

# review the orders

for item in planned_orders.to_buy:

print(item)

# purchase the buy list

provider.purchase_order_plan(plan = planned_orders, fractional_shares=False, skip_errored_stocks=False)

[!TIP] You can set environment variables to avoid having to pass in your credentials each time. THese are specified per provider. For Alpaca, you can set ALPACA_API_KEY and ALPACA_API_SECRET.

Robinhood is also commission free and supports fractional shares.

from py_portfolio_index import RobinhoodProvider, PurchaseStrategy, compare_portfolios, Logger, INDEXES, STOCK_LISTS

from logging import INFO, StreamHandler

Logger.addHandler(StreamHandler())

Logger.setLevel(INFO)

ideal_port = INDEXES['small_cap']

# create a stock list

STOCK_LISTS.add_list('manual_override', ['MDLZ'])

# modify the index

ideal_port.exclude(STOCK_LISTS['oil']).exclude(STOCK_LISTS['vice']).exclude(STOCK_LISTS['cruises']).exclude(

STOCK_LISTS['manual_override'])

# overweight on stonks

ideal_port.reweight(STOCK_LISTS['renewable'], weight=2.0, min_weight=.001)

ideal_port.reweight(STOCK_LISTS['semiconductor'], weight=2.0, min_weight=.001)

provider = RobinhoodProvider(username='#####', password='#########')

real_port = provider.get_holdings()

TARGET_SIZE = 10000

planned_orders = generate_order_plan(ideal=ideal_portfolio, real=real_port,

buy_order=PurchaseStrategy.LARGEST_DIFF_FIRST,

target_size=TARGET_PORTFOLIO_SIZE)

# review the orders

for item in planned_orders.to_buy:

print(item)

# purchase the buy list

provider.purchase_order_plan(plan = planned_orders, fractional_shares=False, skip_errored_stocks=False)

Webull support is mature. Follow similar patterns to the above examples, but use the WebullProvider.

This currently uses this unoffical API package, and requires you to follow device-id authorization path from their docs.

from py_portfolio_index import WebullProvider

Schwab support is experimental. Follow similar patterns to the above examples, but use the ScwhabProvider.

This currently uses this unoffical API package, and requires you to create an app on the schwab website and follow the authorization path from their docs.

from py_portfolio_index import SchwabProvider

To avoid actually purchasing a stock, use the plan_only option to log what trades would have occurred.

provider.purchase_order_plan(plan = planned_orders, plan_only=True )

Can be found in the examples folder.

It can be helpful to configure the logger to print messages. You can either configure the standard python logger or use the portfolio specific one using an example like the below.

Relevant messages are at both INFO and DEBUG levels.

from py_portfolio_index.constants import Logger

from logging import INFO, StreamHandler

Logger.addHandler(StreamHandler())

Logger.setLevel(INFO)

FAQs

Build index portfolios.

We found that py-portfolio-index demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 1 open source maintainer collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Security News

Research

The Socket Research Team breaks down a malicious wrapper package that uses obfuscation to harvest credentials and exfiltrate sensitive data.

Research

Security News

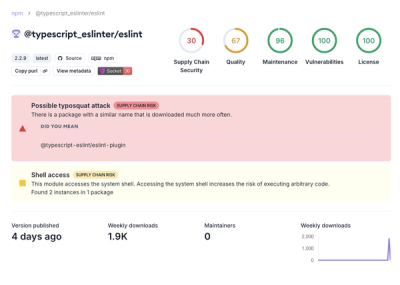

Attackers used a malicious npm package typosquatting a popular ESLint plugin to steal sensitive data, execute commands, and exploit developer systems.

Security News

The Ultralytics' PyPI Package was compromised four times in one weekend through GitHub Actions cache poisoning and failure to rotate previously compromised API tokens.