Security News

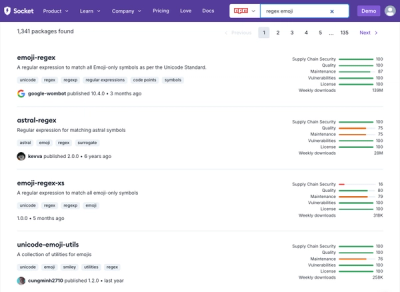

Weekly Downloads Now Available in npm Package Search Results

Socket's package search now displays weekly downloads for npm packages, helping developers quickly assess popularity and make more informed decisions.

@spritz-finance/api-client

Advanced tools

Typescript library for interacting with the Spritz Finance API

A Typescript library for interacting with the Spritz Finance API

npm install --save @spritz-finance/api-client

yarn add @spritz-finance/api-client

Purpose: As an integrator, this guide will assist you in creating users and performing user-specific operations on the Spritz platform using the provided API key.

When you create a user using your integration key:

API key specific to that user.Using the user-specific API key, you can:

Your integration key is provided by Spritz and must always be provided. The api key is specific to each user, and is returned once the user is created. Leave the api key blank if you haven't created the user yet.

import { SpritzApiClient, Environment } from '@spritz-finance/api-client'

const client = SpritzApiClient.initialize({

environment: Environment.Staging,

apiKey: 'YOUR_USER_API_KEY_HERE',

integrationKey: 'YOUR_INTEGRATION_KEY_HERE',

})

To create a new Spritz user, all you need is the user's email address. Note that trying to create a user with an email that already exists in the Spritz platform will throw an error.

const user = await client.user.create({

email: 'bilbo@shiremail.net',

})

// Response

user = {

email: "bilbo@shiremail.net"

userId: "62d17d3b377dab6c1342136e",

apiKey: "ak_ZTBGDcjfdTg3NmYtZDJlZC00ZjYyLThlMDMtZmYwNDJiZDRlMWZm"

}

After creating a user, you can easily set the user's API key onto your initialized client using the provided method:

client.setApiKey(user.apiKey)

Now you're ready to issue requests on behalf of the user.

There is a scenrio where you may need to get access to a users API key again. This can happen if you are trying to sign in a user that already has a Spritz account, or if you have lost access to their API key. In this case, you can reauthorize the user by providing their email. The process is that we will send the user an OTP code to their email, and then the user must pass that code on to you to confirm that they are allowing you to interact with their account on their behalf.

const { success } = await client.user.requestApiKey('bilbo@shiremail.net')

const { apiKey, userId, email } = await client.user.authorizeApiKeyWithOTP({

email: 'bilbo@shiremail.net',

otp: '123456',

})

Use this to fetch the user's basic data

const userData = await client.user.getCurrentUser()

Purpose: To ensure users are properly identified before interacting with the Spritz platform.

All users must undergo basic identity verification before they can engage with the Spritz platform's features.

User Creation: Upon the creation of a new user, their default verification status will be set to INITIALIZED.

Checking Verification Status: Use the getUserVerification method to retrieve the current verification status of a user.

Verification Transition: Once a user completes the identity verification process, their status will change from INITIALIZED to ACTIVE. Only then can the user fully interact with the platform.

Getting Verification URL: When you request a user's verification status, the response will provide a verificationUrl. This URL is essential for the user to proceed with their identity verification.

Here are some options on how you can present the verificationUrl to the user:

const verificationData = await client.user.getUserVerification()

Execute a payment in a few simple steps:

getWeb3PaymentParams method to obtain the necessary transaction data for fulfilling the payment request.For Spritz to process a TradFi payment to an account, we need to receive a blockchain transaction on our smart contract, which provides us the crypto funds. As an integrator, it's essential to manage how the blockchain transaction is initiated from the user's wallet to Spritz.

getWeb3PaymentParams.If your application doesn't have a connection to the user's wallet, consider implementing one. Some popular options include:

// Fetch all bank accounts for the user

const bankAccounts = await client.bankAccount.list()

// Choose a bank account to use for the payment request

const account = bankAccounts[0]

// Create a payment request for the selected bank account

const paymentRequest = await client.paymentRequest.create({

amount: 100,

accountId: account.id,

network: PaymentNetwork.Ethereum,

})

// Retrieve the transaction data required to issue a blockchain transaction

const transactionData = await client.paymentRequest.getWeb3PaymentParams({

paymentRequest,

paymentTokenAddress: '0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48', // USDC on mainnet

})

/**

* Issue blockchain transaction with the transaction data

* and wait for confirmation

**/

// Retrieve the payment issued for the payment request to check the payment status and confirmation

const payment = await client.payment.getForPaymentRequest(paymentRequest.id)

Spritz emphasizes its capabilities in account handling and payment processing.

Spritz supports three distinct types of accounts:

Though each account type possesses its unique creation process and specific properties, it's important to understand that all of them are uniformly termed as an "account" within the Spritz platform.

Recognizing these nuances is crucial for optimal interaction with the Spritz platform's account-related features.

Spritz offers a dedicated interface to manage bank accounts, allowing seamless listing and addition of bank account details for users.

To retrieve all bank accounts linked to a user:

const bankAccounts = await client.bankAccount.list()

The bankAccount.list() method returns an array of user-linked bank accounts, complete with essential details to display in a UI and facilitate payments:

const bankAccounts = [{

id: "62d17d3b377dab6c1342136e",

name: "Precious Savings",

type: "BankAccount",

bankAccountType: "USBankAccount",

bankAccountSubType: "Checking",

userId: "62d17d3b377dab6c1342136e",

accountNumber: "1234567",

bankAccountDetails: {

routingNumber: "00000123",

}

country: "US",

currency: "USD",

email: "bilbo@shiremail.net",

holder: "Bilbo Baggins",

institution: {

id: "62d27d4b277dab3c1342126e",

name: "Shire Bank",

logo: "https://tinyurl.com/shire-bank-logo",

},

ownedByUser: true,

createdAt: "2023-05-03T11:25:02.401Z",

deliveryMethods: ['STANDARD', 'INSTANT']

}]

Currently, Spritz supports the addition of US bank accounts:

The input structure for adding a US bank account is defined as:

// Input arguments for creating a US bank account

export interface USBankAccountInput {

accountNumber: string

email: string

holder: string

name: string

ownedByUser?: boolean | null

routingNumber: string

subType: BankAccountSubType

}

import { BankAccountType, BankAccountSubType } from '@spritz-finance/api-client'

const bankAccounts = await client.bankAccount.create(BankAccountType.USBankAccount, {

accountNumber: '123456789',

routingNumber: '987654321',

holder: 'Bilbo Baggins',

name: 'Precious Savings',

ownedByUser: true,

subType: BankAccountSubType.Savings,

})

Currently, Spritz supports the addition of Canadian bank accounts:

The input structure for adding a Canadian bank account is defined as:

// Input arguments for creating a Canadian bank account

export interface CABankAccountInput {

accountNumber: string

email?: string

holder: string

name: string

ownedByUser?: boolean | null

transitNumber: string

institutionNumber: string

subType: BankAccountSubType

}

import { BankAccountType, BankAccountSubType } from '@spritz-finance/api-client'

const bankAccounts = await client.bankAccount.create(BankAccountType.CABankAccount, {

accountNumber: '123456789',

transitNumber: '12345',

institutionNumber: '123',

holder: 'Bilbo Baggins',

name: 'Precious Savings',

ownedByUser: true,

subType: BankAccountSubType.Savings,

})

Spritz provides robust support for bills, allowing seamless management and interaction with user billing accounts. Below is a guide to the methods and functionalities specifically designed for handling bills within Spritz.

To retrieve all bill accounts associated with a user:

const bills = await client.bill.list()

The bill.list() method returns an array of user-associated bills, complete with essential details for display in a UI and for processing payments:

const bills = [

{

id: '62d17d3b377dab6c1342136e',

name: 'Precious Credit Card',

type: 'Bill',

billType: 'CreditCard',

userId: '62d17d3b377dab6c1342136e',

mask: '4567',

originator: 'User',

payable: true,

verifying: false,

billAccountDetails: {

balance: 240.23,

amountDue: 28.34,

openedAt: '2023-05-03T11:25:02.401Z',

lastPaymentAmount: null,

lastPaymentDate: null,

nextPaymentDueDate: '2023-06-03T11:25:02.401Z',

nextPaymentMinimumAmount: 28.34,

lastStatementBalance: 180.23,

remainingStatementBalance: null,

},

country: 'US',

currency: 'USD',

dataSync: {

lastSync: '2023-05-03T11:25:02.401Z',

syncStatus: 'Active',

},

institution: {

id: '62d27d4b277dab3c1342126e',

name: 'Shire Bank Credit Card',

logo: 'https://tinyurl.com/shire-bank-logo',

},

createdAt: '2023-05-03T11:25:02.401Z',

deliveryMethods: ['STANDARD']

},

]

Currently, Spritz allows the addition of US bill accounts only. The process involves identifying the institution managing the bill and inputting the bill's account number. Here's a guide on how to add a bill for a user:

import { BillType } from '@spritz-finance/api-client'

const institutions = await client.institution.popularUSBillInstitutions(BillType.CreditCard)

const billInstitution = institutions[0]

const accountNumber = '12345678913213'

const bill = await client.bill.create(billInstitution.id, accountNumber, BillType.CreditCard)

Spritz offers the ability to create virtual cards that users can fund using cryptocurrency. These virtual cards represent an alternative payment account offered by Spritz. To effectively interact with the Virtual Card feature, use the API endpoints detailed below.

The fetch endpoint returns an object containing details associated with the virtual card. Importantly, this object excludes sensitive card information such as the card number and the CVV.

const virtualCard = await client.virtualCard.fetch()

const virtualCard = {

id: '62d17d3b377dab6c1342136e',

type: 'VirtualCard',

virtualCardType: 'USVirtualDebitCard',

userId: '62d17d3b377dab6c1342136e',

mask: '0001',

country: 'US',

currency: 'USD',

balance: 0,

renderSecret: 'U2FsdGVkX18bLYGYLILf4AeW5fOl8VYxAvKWVDtbZI5DO7swFqkJ2o',

billingInfo: {

holder: 'Bilbo Baggins',

phone: '+123456789',

email: 'bilbo@shiremail.net',

address: {

street: '1 Bagshot Row',

street2: '',

city: 'Hobbiton',

subdivision: 'The Shire',

postalCode: '12345',

countryCode: 'ME',

},

},

}

import { VirtualCardType } from '@spritz-finance/api-client'

const virtualCard = await client.virtualCard.create(VirtualCardType.USVirtualDebitCard)

To show the sensitive card details that users require for payment transactions, you must integrate our dedicated drop-in widget. This widget securely renders card details. Use the renderSecret, obtained from the standard fetch card endpoint, in conjunction with the user's API key.

We currently support and maintain the following packages for the card rendering process:

You can conveniently change the display name of a bank account using the following endpoint. The first argument specifies the ID of the bank account, while the second argument represents the desired new name for the account.

const updateAccount = await client.bankAccount.rename('62d17d3b377dab6c1342136e', 'My new account')

You can conveniently change the display name of a bill using the following endpoint. The first argument specifies the ID of the bill, while the second argument represents the desired new name for the account.

const updateAccount = await client.bill.rename('62d17d3b377dab6c1342136e', 'My first credit card')

To remove a bank account from a user's account, you can use the following endpoint. You only need to specify the ID of the bank account that you want to delete as an argument.

await client.bankAccount.delete('62d17d3b377dab6c1342136e')

To remove a bill from a user's account, you can use the following endpoint. You only need to specify the ID of the bill that you want to delete as an argument.

await client.bill.delete('62d17d3b377dab6c1342136e')

When adding a new bill for a user, we need to provide a reference to the institution who holds the account for the user. As an example, if a user wanted to add their Chase Visa Credit Card to their Spritz account, the Institution of the account would be Chase Credit Cards and then the account number provided would be the 16-digit card number for their credit card.

Spritz exposes several endpoints to help users find the Institutions of their bill accounts.

const popularInstitutions = await client.institution.popularUSBillInstitutions()

// Optionally filter by a specific bill type

const popularInstitutions = await client.institution.popularUSBillInstitutions(BillType.Mortgage)

const institutions = await client.institution.searchUSBillInstitutions('american express')

// Optionally filter by a specific bill type

const institutions = await client.institution.searchUSBillInstitutions(

'american express',

BillType.CreditCard

)

A payment request refers to the intent to initiate a payment to a specific account. Once a payment request is created, a blockchain transaction is required to fulfill it. After the blockchain transaction settles, the payment request is completed, and a fiat payment is issued to the designated account.

To initiate a payment request for a specific account, you can use the following functionality. The required inputs for creating a payment request include the ID of the account to be paid, the amount of the fiat payment in USD, and the network on which the blockchain transaction will settle.

import {PaymentNetwork} from '@spritz-finance/api-client';

const paymentRequest = await client.paymentRequest.create({

amount: 100,

accountId: account.id,

network: PaymentNetwork.Ethereum,

deliveryMethod: 'INSTANT'

});

// Example response

{

id: '645399c8c1ac408007b12273',

userId: '63d12d3B577fab6c6382136e',

accountId: '6322445f10d3f4d19c4d72fe',

status: 'CREATED',

amount: 100,

feeAmount: 0,

amountDue: 100,

network: 'ethereum',

createdAt: '2023-05-04T11:40:56.488Z'

}

After creating a payment request, you must issue a blockchain transaction to settle the payment request. For EVM compatible networks, this involves interacting with the SpritzPay smart contract (see: SpritzPay deployments).

To obtain the data needed for the transaction, you can use the following endpoint.

import {PaymentNetwork} from '@spritz-finance/api-client';

const paymentRequest = await client.paymentRequest.create({

amount: 100,

accountId: account.id,

network: PaymentNetwork.Ethereum,

});

const transactionData = await client.paymentRequest.getWeb3PaymentParams({

paymentRequest,

paymentTokenAddress: '0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48', // USDC on mainnet

})

// Example response

{

contractAddress: '0xbF7Abc15f00a8C2d6b13A952c58d12b7c194A8D0',

method: 'payWithToken',

calldata: '0xd71d9632000000000000000000000000a0b86991c6218b36c1d19d4a2e9eb0ce3606eb480000000000000000000000000000000000000000000000000000000005f5e100000000000000000000000000000000000000000064539a31c1ac408007b12277',

value: null,

requiredTokenInput: '100000000',

suggestedGasLimit: '110000'

}

The contract address (to), calldata (data), and value are the primary components used to execute the blockchain transaction. You can use the requiredTokenInput to verify that the user's wallet has sufficient funds to complete the payment before initiating the transaction.

Transaction fees are applied once the monthly transaction volume exceeds $100. To determine the fee amount for a specific payment value, you can use the following endpoint.

const fees = await client.paymentRequest.transactionPrice(101)

// Example response

0.01

Payments represent a fiat payment that has been issued to the account. Once the status of the Payment Request has moved to Confirmed then the Payment will be created.

import {PaymentNetwork} from '@spritz-finance/api-client';

const paymentRequest = await client.paymentRequest.create({

amount: 100,

accountId: account.id,

network: PaymentNetwork.Ethereum,

});

const payment = await client.payment.getForPaymentRequest(paymentRequest.id);

// Example response

{

id: '6368e3a3ec516e9572bbd23b',

userId: '63d12d3B577fab6c6382136e',

status: 'PENDING',

accountId: '6322445f10d3f4d19c4d72fe',

amount: 100,

feeAmount: null,

createdAt: '2022-11-07T10:53:23.998Z'

}

const payments = await client.payment.listForAccount(account.id)

// Example response

[

{

id: '6368e3a3ec516e9572bbd23b',

userId: '63d12d3B577fab6c6382136e',

status: 'PENDING',

accountId: '6322445f10d3f4d19c4d72fe',

amount: 100,

feeAmount: null,

createdAt: '2022-11-07T10:53:23.998Z',

},

]

Instead of making a request to get information, webhooks send information to your specified endpoint as soon as an event occurs. Spritz's integration offers a variety of webhook events that can be crucial for maintaining data integrity and responsiveness in applications. Let's dive into how you can best utilize these.

Spritz currently supports the following webhook events:

account.created: Triggered when a new account is created.account.updated: Triggered when details of an account are updated.account.deleted: Triggered when an account is deleted.payment.created: Triggered when a new payment is initiated.payment.updated: Triggered when details of a payment are updated.payment.completed: Triggered when a payment is successfully completed.payment.refunded: Triggered when a payment is refunded.These events allow you to respond to changes in the account and payments for a user.

To set up a webhook with Spritz, you'll need to provide:

const webhook = await client.webhook.create({

url: 'https://my.webhook.url/spritz',

events: ['account.created', 'account.updated', 'account.deleted'],

})

Upon receiving a webhook, your server will get a payload with the following structure:

{

"userId": "user-id-here",

"id": "resource-id-here",

"eventName": "name-of-the-event-here"

}

FAQs

Typescript library for interacting with the Spritz Finance API

The npm package @spritz-finance/api-client receives a total of 153 weekly downloads. As such, @spritz-finance/api-client popularity was classified as not popular.

We found that @spritz-finance/api-client demonstrated a healthy version release cadence and project activity because the last version was released less than a year ago. It has 2 open source maintainers collaborating on the project.

Did you know?

Socket for GitHub automatically highlights issues in each pull request and monitors the health of all your open source dependencies. Discover the contents of your packages and block harmful activity before you install or update your dependencies.

Security News

Socket's package search now displays weekly downloads for npm packages, helping developers quickly assess popularity and make more informed decisions.

Security News

A Stanford study reveals 9.5% of engineers contribute almost nothing, costing tech $90B annually, with remote work fueling the rise of "ghost engineers."

Research

Security News

Socket’s threat research team has detected six malicious npm packages typosquatting popular libraries to insert SSH backdoors.